Sep 22, 2022

Gold Steadies Near Two-Year Low After Parade of Rate Hikes

, Bloomberg News

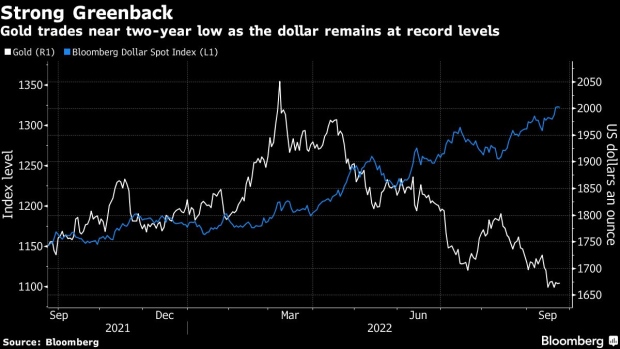

(Bloomberg) -- Gold sank to the lowest level since the early days of the pandemic, caught up in a broad selloff after a slew of central banks followed the Federal Reserve in raising interest rates to cool inflation.

Bullion flirted with slipping into a bear market, closing nearly 20% below the all-time high reached in March amid a broad retreat in everything from commodities to stocks as the dollar climbed to a record. Investors shed risky assets for cash after the UK’s economic plan reignited concerns that central banks’ aggressive interest-rate hikes may lead to a recession.

Weakness in bullion is “very likely to persist” due to “monetary tightening that makes gold costlier to hold,” said Gnanasekar Thiagarajan, director at Commtrendz Risk Management Services. “However, recession fears and any escalation in the Russia and Ukraine conflict could support prices.”

Central banks in Switzerland, Norway and Britain followed the Fed’s lead in announcing interest-rate hikes to curb price increases. Gold, which doesn’t bear interest and is priced in the US currency, usually has a negative correlation with the dollar and rates.

Outflows from exchange-traded funds have continued, with holdings now close to the lowest this year. US business activity contracted in September for a third straight month, though at a more moderate pace as a pickup in orders and a further softening of inflation allayed concerns of a more-pronounced pullback.

Spot gold declined 1.6% to $1,643.94 an ounce, capping a second weekly loss. Bullion for December delivery fell 1.5% to settle at $1,655.60 on the Comex. The Bloomberg Dollar Spot Index climbed 1.3% to a record high. Silver, platinum and palladium all tumbled.

Money managers became the most bearish on gold in almost four years, boosting their net-short position in Comex futures and options by 22,834 contracts in the week through Sept. 20, according to US government data.

©2022 Bloomberg L.P.