Nov 11, 2019

Gold Trade Equal to 3 Million Ounces Sends Futures Tumbling

, Bloomberg News

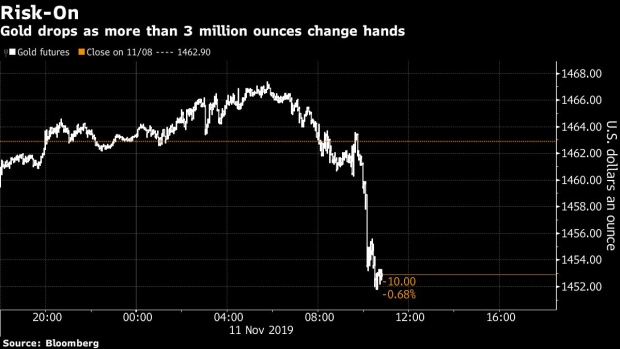

(Bloomberg) -- Gold futures tumbled to a three-month low as contracts equal to over 3 million ounces changed hands in half an hour, fueling the sell-off.

In the 30 minutes ended 10:30 a.m. in New York, 33,596 contracts were traded, more than triple the 100-day average for that time of day. That helped pushed the most active contract to as low as $1,448.90 an ounce, the lowest since Aug. 5.

“The sharp, violent move lower quickly suggests stops or a liquidation,” Tai Wong, the head of metals derivatives trading at BMO Capital Markets, said in an email.

On Friday, the Commodity Futures Trading Commission released data showing hedge funds boosting their bets on gold’s decline by 15% to 31,111 futures and options in the week ended Nov. 5, the highest since early June.

To contact the reporter on this story: Luzi Ann Javier in New York at ljavier@bloomberg.net

To contact the editor responsible for this story: Luzi Ann Javier at ljavier@bloomberg.net

©2019 Bloomberg L.P.