Feb 12, 2019

Gold Won’t Solve Your Budget Problems

, Bloomberg News

(Bloomberg Opinion) -- Most of us have a few coins lost down the backs of our sofas. Only the foolish think they can solve their money worries by fishing them out.

That’s more or less what politicians in Venezuela and Italy are contemplating at the moment, though. The Latin American government sold more than 40 percent of its gold reserves last year to fund government spending and bond payments, according to opposition lawmakers.

Italy, too, has been roiled with controversy this week after La Stampa newspaper reported that the government was considering selling part of its gold reserves to support its budget – an interpretation of a proposed law rejected by its backer, but which Deputy Prime Minister Matteo Salvini has nonetheless described as “an interesting idea.”

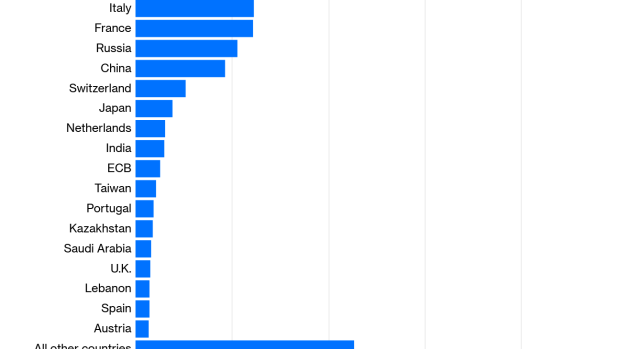

It’s certainly true that the two countries’ central banks probably hold more gold than they need. About 77 percent of Venezuela’s foreign-reserve assets are bullion, according to the World Gold Council, a higher share than in any other major economy. After it, only the U.S., Germany, and Tajikistan have a bigger proportion of gold on their central-bank balance sheets than Italy’s 66 percent.

That’s in many ways an accident of history. Since the end of the gold-standard era, there’s been little need for central banks to own much more of the metal than the single-digit percentages held by China, Switzerland, Japan, the U.K. and other major economies.

Having a large share of reserves in metal can leave central banks overexposed to the movements of a single volatile asset, in contrast to a portfolio comprising a range of currencies and the IMF’s Special Drawing Rights. In addition, gold is costly to store and trade compared with banknotes and deposits. Unlike foreign government bonds, it doesn’t provide any return.

As a result, the main reason for holding it – beyond the zombie-apocalypse arguments that it’s default-proof – is that it tends to attract safe-haven demand in the teeth of a crisis. Because of this counter-cyclical behavior, a sprinkling of yellow metal can reduce the overall volatility of a portfolio. Too much, though, can produce the opposite effect, such as when the dollar price of gold fell by 28 percent in 2013.

So why not sell out?

One problem is that it won’t make much of a difference. Italy’s trailing 12-month budget deficit is currently running at around 44 billion euros ($50 billion). That’s equivalent to about 1,180 metric tons of gold at current prices, a bit less than half of the Bank of Italy’s total holdings or a third of its total foreign reserves. No one’s suggesting (yet) that Italy should meet all of its overspending with bullion sales, but the numbers should illustrate how quickly your central bank nest egg can get used up.

In addition, selling off the fourth-biggest pile of gold out there is likely to have its own effect on the market.

The Malian king Mansa Musa crashed the Middle Eastern gold market and caused a wave of inflation when he passed through on pilgrimage to Mecca in the 14th century, dispensing the largess of his west African mines on his way. The same thing happened on a smaller scale in the late 1990s when the Bank of England and Swiss National Bank decided to cut their bullion holdings, which helped drive gold to a multi-decade low of $252.55 a troy ounce and prompted European central banks to sign a five-year agreement limiting their sales to no more than 400 tons a year.(1)

Central banks own about one-sixth of the world’s gold, giving their moves an outsize impact on prices. Anyone trying to sell off Italy’s reserves would find that all those bars and coins were suddenly worth a lot less than they thought they were.

The bigger issue, however, is what it would mean for Italy’s remaining 2.3 trillion euros in debt. In India, the central bank has faced pressure from New Delhi to use its foreign reserves to support the budget. As Reserve Bank of India Deputy Governor Viral Acharya argued last year, such moves by a government can lead to a “grave reassessment of its sovereign risk.” That ultimately translates into higher interest payments, negating any short-term benefit.

The austerity imposed on Italy via the constraints of the euro zone is certainly frustrating, and damaging to an economy that’s just entered its third recession in a decade. But the experience of Venezuela, a country that once hitched its fortunes to bullion, should be a warning that central bank reserve assets aren’t a bottomless piggy bank. Go too far down that path, and you risk finding that gold is all you have left to sell.

(1) The most recent of those agreements, which doesn’t put a formal cap on sales, is set to expire later this year.

To contact the author of this story: David Fickling at dfickling@bloomberg.net

To contact the editor responsible for this story: Rachel Rosenthal at rrosenthal21@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

David Fickling is a Bloomberg Opinion columnist covering commodities, as well as industrial and consumer companies. He has been a reporter for Bloomberg News, Dow Jones, the Wall Street Journal, the Financial Times and the Guardian.

©2019 Bloomberg L.P.