Mar 21, 2022

Goldman, Barclays Cut 2022 Russia Outlook, See Double-Digit Drop

, Bloomberg News

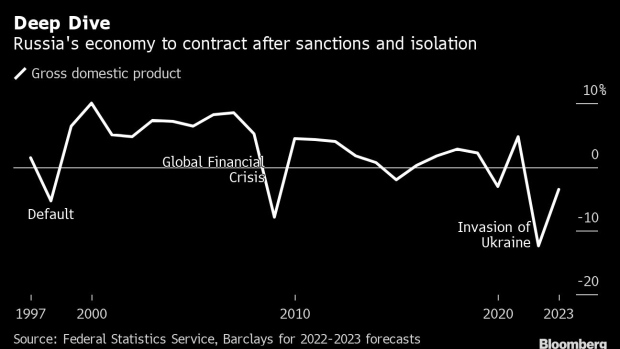

(Bloomberg) -- Economists from Barclays Plc and Goldman Sachs Group Inc. lowered their forecasts for Russia and now see a double-digit contraction in output this year, the latest in a batch of revisions that reckon with the increased severity of sanctions over the invasion of Ukraine.

Barclays released one of the most downbeat views yet, reversing its previous calls for growth and predicting a contraction of 12.4% in 2022 and a further decline of 3.5% the following year. Goldman downgraded this year’s forecast and now expects a slump of 10%, from a 7% drop seen earlier.

“Due to the current geopolitical conditions, we assume sanctions will be long-lasting,” Barclays economists including Brahim Razgallah said in a note.

“The economic slowdown will be gradual and accelerate by mid-2022, as the consequences of sanctions fully translate to the economy,” they said. “We expect the economic contraction will be driven by fall of private consumption, investment and imports.”

Just over three weeks since President Vladimir Putin ordered Russia’s military to attack Ukraine, an economy that was on track to expand for a second year is sinking into its deepest downturn this century.

Putin has warned the country faces rising joblessness and inflation as it adjusts to what he described as an “economic blitzkrieg” of international sanctions. Bloomberg Economics’ initial forecast is for Russia’s full-year GDP to slump about 9% in 2022.

Goldman’s economists led by Clemens Grafe said in a note that “Russia’s exports are more strongly disrupted than we had initially assumed,” accounting for about half of the bank’s downward revision in outlook. Goldman’s base case is that Russia’s gas exports will continue uninterrupted, but its oil shipments will drop by close to 20%.

It now expects exports to fall by 20% sequentially in the second quarter and by 10% for the year. Goldman also assumes a 20% drop in the volume of imports in 2022.

At the same time, the products Russia exports rely on few imported parts, according to Goldman. In the case of mining, the sector relies on imports for only about 7% of its intermediate purchases of goods and services, it said, citing the latest available data for 2019.

Less Integrated

“The impact of trade sanctions on Russia is unlikely to be as damaging for the economy as it would be for other economies that are more integrated into global supply chains,” Goldman said.

The U.S. bank foresees a “slow recovery,” with growth turning positive already next year. GDP is set to expand 2.4% in 2023 and 3.4% in 2024, it said.

The outlook is far less dire for Russia’s finances. In the absence of further trade restrictions and with high commodity prices, Barclays believes Russia will be able to fund its main spending needs.

In Goldman’s view, Russia’s current-account surplus is actually improving slightly despite the sharp declines in imports and exports.

It now expects the current-account balance -- the broadest measure of trade in goods and services -- to reach a record $205 billion for 2022, under the assumption that Russia will continue to service its debt and allows dividend payments.

©2022 Bloomberg L.P.