Feb 6, 2023

Goldman Cuts US Recession Odds to 25% on Jobs, Business Outlook

, Bloomberg News

(Bloomberg) -- Economists at Goldman Sachs Group Inc. said the risk of a US recession is receding amid a persistently strong jobs market and signs of improving business sentiment.

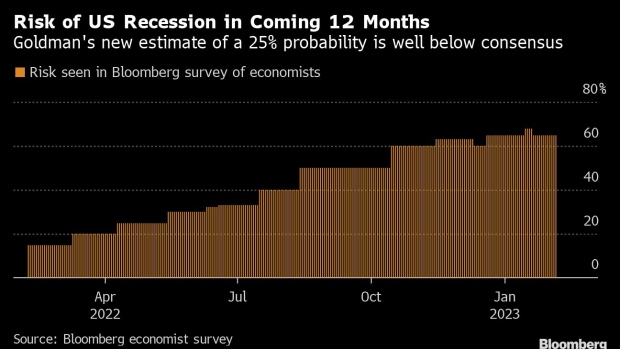

The Goldman team led by Jan Hatzius cut its estimate for the probability of a recession in the next 12 months to 25% from 35%. By contrast, Bloomberg’s survey of economists last month pointed to a 65% chance of a downturn within that time. Historically the typical chance of a recession in any 12-month period is roughly 15%.

“Continued strength in the labor market and early signs of improvement in the business surveys suggest that the risk of a near-term slump has diminished notably,” Hatzius wrote. Employers added more than half a million jobs in January, well above expectations, according to data published Friday.

Read More: Jobs Galore Give US Consumers Firepower to Fight Off Recession

Goldman also pointed to a rapid slowdown in inflation, and wage growth that’s cooling down toward a level that’s compatible with the Federal Reserve’s 2% inflation target. The outlook supports the Fed’s view that a so-called “soft landing” for the economy is achievable, and also its inclination to raise interest rates by another 25 basis points in both the March and May monetary policy meetings, Hatzius wrote.

Better-than-expected growth in other major economies will also be helpful for the US, Goldman said, predicting that the euro area will avoid a recession and China will rebound rapidly.

On financial markets, the resilience of the economy “should support cyclical assets,” although upside for investors may be capped because equity valuations are already high, especially in the US, and profit margins are elevated, according to Hatzius.

©2023 Bloomberg L.P.