Jan 10, 2019

Goldman predicts gold prices to climb to highest since 2013

, Bloomberg News

Goldman Sachs Group Inc. is leading a pack of bullish voices cheering for gold.

The New-York based bank’s analysts led by Jeffrey Currie raised their price forecast for gold, predicting that over the next 12 months, the precious metal will climb to US$1,425 an ounce -- a level not seen in more than five years. Bullion has benefited as rising geopolitical tensions fuel central bank purchases while fears of a recession helped boost demand from investors seeking “defensive assets,” they said.

Even exchange-traded funds are piling into bullion, taking their holdings to the highest since May. On the Comex in New York, prices have climbed 10 per cent from a low in August. Speculative interest in the gold signals investors are not only closing bearish bets but are also adding to their bullish position, Suki Cooper, a New York-based analyst at Standard Chartered, said in a note.

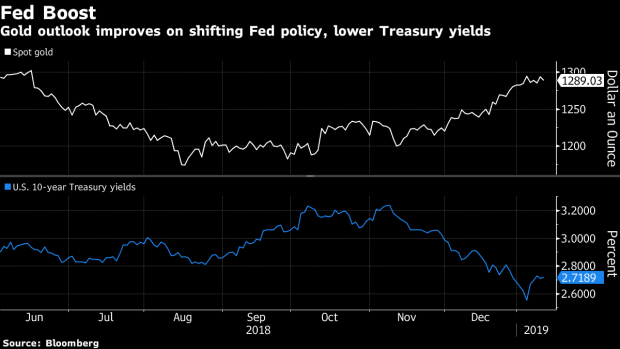

Gold is also getting a boost from mounting speculation the Federal Reserve may pause in raising borrowing costs, boosting the appeal of non-interest-bearing metal.

“We expect the safe haven bid, and to a lesser extent, gold’s inflation hedge properties, to remain key drivers of the metal’s price in 2019, complemented by a resurgence of physical demand,’’ Cantor Fitzgerald analysts led by Mike Kozak said in a report. Gold and silver are ‘‘looking good in 2019,’’ underlining a potentially positive indicators that ‘‘should drive a bullish case” for both metals “and as a result, the related equities as well.’’

--With assistance from Caleb Mutua.