Jun 6, 2023

Goldman Prepares to Enter Japan’s Growing Power Futures Market

, Bloomberg News

(Bloomberg) -- Goldman Sachs Group Inc. is in the process of setting up a trading desk to handle Japanese power derivatives, according to people familiar with the matter.

The bank is the latest to show interest in Japan’s power sector as the nation’s utilities increasingly hedge their exposure to volatile energy markets, said the people, who asked not to be named as the details are private.

A spokesperson for Goldman Sachs declined to comment.

Japan-based Mizuho Financial Group Inc., one of the country’s largest banks, is also considering whether to start trading in the market. “Due to the recent surge in energy prices, awareness for power price hedging is growing,” a Mizuho spokesperson said.

Mizuho hasn’t begun any trading so far, though it is “keeping close watch of market trends,” the spokesperson said.

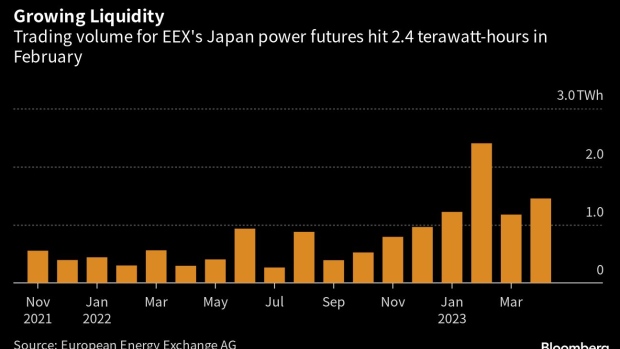

Japan’s power market, which was liberalized in 2016, has seen trading balloon with the addition of more firms. The volume of Japanese power derivatives on European Energy Exchange AG, the bourse with the most popular offering, surged almost 400% in April from the same month last year.

While the nascent market is still a fraction of the size of mature ones in places like Germany, Japan’s increasing renewable energy demand and seasonal fluctuations have spurred volatility and arbitrage opportunities, attracting traders.

EEX’s increase in trading participants and volume is creating “interest for the next group of customers,” said Chief Operating Officer Steffen Koehler. The exchange currently has 56 Japan power trading participants, including the nation’s top power producer Jera Co. and some regional utilities, like Tohoku Electric Power Co.

“It always starts with physical players, who are active in their respective underlying market,” followed by financial ones, Koehler said. “The moment you are able to acquire the financial players, you are able to grow and improve the liquidity.”

--With assistance from Takashi Nakamichi and Taiga Uranaka.

©2023 Bloomberg L.P.