Jun 6, 2022

Goldman Returns to ESG Debt Market With $700 Million Deal

, Bloomberg News

(Bloomberg) -- Goldman Sachs Group Inc. is raising $700 million in the US investment-grade market to help fund environmental and social initiatives, its first benchmark sustainable-bond sale in over a year.

The New York-based lender is selling a sustainability bond maturing in five years, according to a person with knowledge of the matter. The self-led deal may yield 1.6 percentage points above Treasuries, said the person, who asked not to be identified as the details are private. In the US markets, issuance above $500 million is considered a benchmark deal.

Proceeds from the deal will fund a range of projects and assets that respond to critical environmental, social and sustainability issues, including those related to climate transition and inclusive growth, the person said.

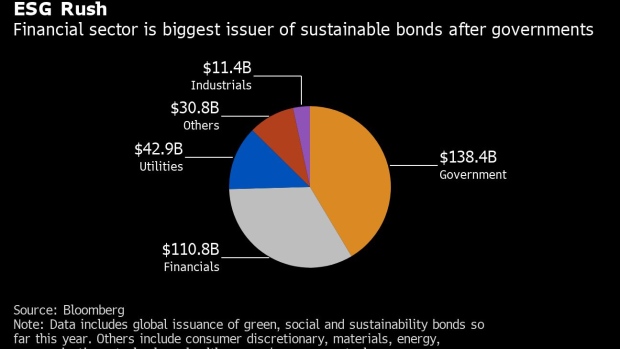

The biggest US banks have become a regular fixture in the global sustainable finance market amid pressure from investors and regulators for the financial sector to do more to address climate change and social issues, including reducing capital flows to fossil fuels. Financial firms globally have raised about $111 billion in sustainable debt this year, making the sector the biggest issuer of sustainable bonds after governments, according to data compiled by Bloomberg.

The sector, despite touting net-zero goals, has continued to channel hundreds of billions of dollars into the world’s biggest polluters.

Read more: Bankers Warned of ‘Credibility Issue’ Amid Dubious CO2 Goals

Goldman first tapped the sustainable finance market in February 2021, when it raised $800 million in sustainable bonds. The bank said at the time that it will issue environmental, social and governance bonds on a regular basis as part of its plans to deploy $750 billion in sustainable financing, investing and advisory activity by 2030.

The bank reached approximately $300 billion of the total goal by end of 2021, including $167 billion to advance climate transition and another $50 billion for inclusive growth initiatives, according to its website.

(Updates with issuance data in fourth graph, a chart and more details on Goldman’s ESG investments)

©2022 Bloomberg L.P.