Aug 3, 2020

Goldman Sachs Comes Up With Tinder for Mergers

, Bloomberg News

(Bloomberg Opinion) -- Call it Deal Tinder. Banker Bumble. Or, perhaps more on trend with the vowel-hating naming convention of startups, simply: Bnkr. That’s not the real name, but Wall Street is building a new dealmaking app for the future of mergers and acquisitions in a social-distanced world. After all, this weekend’s flurry of deal activity shows that not even the coronavirus can stifle M&A demand for long.

As air travel remains taboo, and with working from home set to be the norm for corporate offices for the foreseeable future, bankers are looking for new technologies to help their clients find transactions remotely. The Covid-19 pandemic heralded the rise of Zoom Video Communications Inc. and other videoconferencing tools, which have already been used recently by Verizon Communications Inc. and Intel Corp. to negotiate acquisitions valued at hundreds of millions of dollars. Now, Goldman Sachs Group Inc. is building a merger matchmaking app for its investment-banking clients to further aid the process, Bloomberg’s Ed Hammond reports. The app’s real name is Gemini, building off a technology that the company uses internally. (In case Goldman’s rivals are curious, “Bnkr” is still up for grabs.)

The Gemini news comes on the heels of a busy deals weekend as the M&A market starts to show more signs of life. Microsoft Corp. confirmed that it’s in talks to buy the U.S. side of TikTok as the Chinese-owned social-media sensation comes under scrutiny by the Trump administration. (Tim Culpan writes that it could be “the deal of the decade.”) Germany’s Siemens Healthineers AG struck a $16.4 billion deal to acquire Varian Medical Systems Inc., a Palo Alto, California-based maker of cancer-radiation treatments, with the expectation that demand for medical procedures put off by Covid will return. Private equity firms Blackstone Group Inc. and Global Infrastructure Partners are also considering a joint bid for Kansas City Southern, a railroad operator that links Mexico and the U.S. Midwest, in what would amount to a Warren Buffett-esque bet on the U.S. economy.

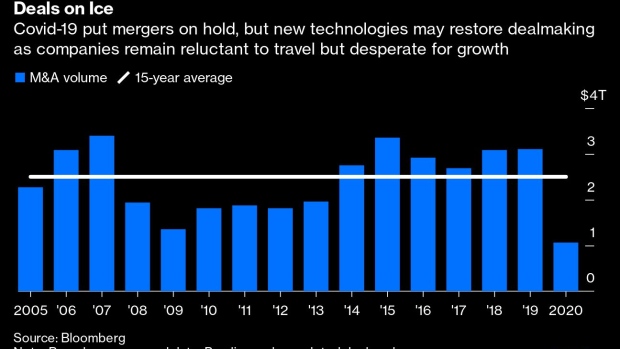

Gone may be the days of a handshake sealing a deal, and M&A volume globally is still down 47% this year at just $1.1 trillion. But the pandemic hasn’t altered the reasons for pursuing transactions. Interest rates remain low amid a global recession triggered by virus fears, and a lack of organic growth continues to point to consolidation across industries. As companies become more comfortable with remote work, they may embrace technology for dealmaking, too.

“The bankers are road warriors, but I think they’re learning quickly that they can get a lot more done this way,” Derek Koecher, Verizon’s vice president of strategy and development, said in a June interview conducted over the BlueJeans videoconferencing software. The wireless carrier acquired BlueJeans for $400 million in April to add to its offerings for business customers.

While Verizon and BlueJeans executives were able to start their negotiations in person in pre-Covid times, once the pandemic hit they were forced to become their own guinea pigs. “That time that you get with the management team — the dinners, the drop-bys, the ‘Hey, I need to come out and see you, let’s have breakfast’ – were completely gone,” Koecher said. “One thing you worry about is culture. Are you going to have the right cultural fit with people you didn’t spend a lot of face-to-face time with? We used the platform to get that management time and intimacy. It was an experiment, and it proved to be quite successful.” No travel delays, and meetings were easier to schedule. There’s also a benefit to being able to literally peer into the other person’s background on screen, a window into their life outside the formal conference-room setting, he said.

Goldman says its app will show how a business stacks up against various revenue and profit metrics, as well as environmental, social and governance standards. (By the way, the Bloomberg terminal can do a lot of that, too. Bloomberg LP is the parent of Bloomberg News and Bloomberg Opinion.) That may help CEOs spot vulnerabilities and merger or spinoff opportunities before activist investors come knocking.(2)

With some inspiration from social-media tools, dealmaking lives on in the Covid era. Maybe even the swipe — the cultural touchstone of millennial dating that’s led to plenty of marriages — could broker mergers next.

(1) There has already been a substantial uptick in the adoption of poison-pill defenses this year.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Tara Lachapelle is a Bloomberg Opinion columnist covering the business of entertainment and telecommunications, as well as broader deals. She previously wrote an M&A column for Bloomberg News.

©2020 Bloomberg L.P.