Jun 27, 2022

Goldman Sachs Says US Rates Market Underprices Recession Risk

, Bloomberg News

(Bloomberg) -- Interest-rate strategists at Goldman Sachs Group Inc. said US markets are underpricing the risk of a recession in 2024 and joined the recent surge in bets to profit from a dovish shift in Federal Reserve policy.

While market-implied expectations for the Fed’s policy rate have declined over the past few weeks to levels that for early 2023 have “limited downside, fed funds pricing in 2024 is likely underpricing the risk of recession,” strategists led by Praveen Korapaty said in a June 24 note. The risk that inflation remains high is complicating how recession fears affect the slope of the yield curve, they said.

To profit from the mispricing, they recommended a eurodollar curve flattening trade involving the March 2023 and March 2024 contracts. Selling calls on the March 2023 versus a long in March 2024 futures monetizes currently high implied volatility, they said.

“We believe that this structure should perform under a range of recession start scenarios, with risks coming from either an immediate recession or a very prolonged hiking cycle,” they wrote.

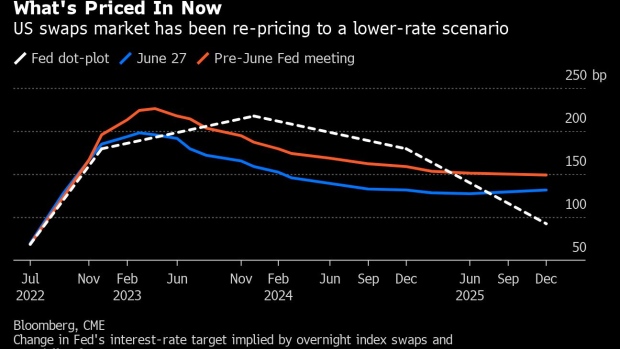

Expectations implied by interest-rate swaps are for the Fed’s policy rate to peak at around 3.60% by March 2023, an increase of about 200 basis points from the current level. That compares with around 4% a couple of weeks ago. Since then, there’s been a proliferation of short-term rate options activity anticipating sharp Fed rate cuts in 2023 and 2024.

©2022 Bloomberg L.P.