Jul 6, 2022

Goldman Sachs Sees Kotak Mahindra Bank Doubling Market Value

, Bloomberg News

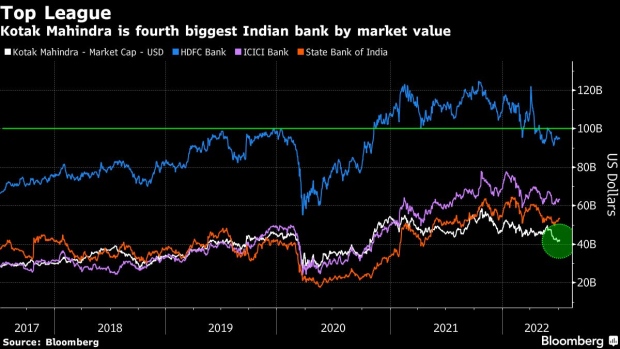

(Bloomberg) -- Kotak Mahindra Bank Ltd., controlled by Asia’s richest financier, Uday Kotak, is set to double its value over the next five years, as its lending business transforms with the help of digital channels, according to Goldman Sachs Group Inc.

The Mumbai-based lender is set to deliver sustainable operating profit and loan growth as it deploys excess equity capital, Goldman analysts wrote in a July 5 note, having upgraded the company to a buy recommendation from neutral. The bank’s valuation may rise beyond $100 billion by 2027, according to the note.

Kotak’s efforts to expand its online banking footprint are showing early signs of benefit, as one-third of its loan disbursal to unsecured borrowers happened through its digital platform during the March quarter. Credit growth in India’s banking system has jumped to a three-year high as the economy shows signs of a revival.

Shares of Kotak Mahindra have underperformed the Nifty Bank Index over the past two years, with its valuation plunging to one-standard deviation below the mean. The bank’s shares jumped 2.3% to 1,701.9 rupees ($21.5) as of 12:51 pm in Mumbai trading, paring this year’s losses to 5%.

©2022 Bloomberg L.P.