Oct 2, 2019

Goldman Says Billions Moved From Hong Kong to Singapore Amid Unrest

, Bloomberg News

(Bloomberg) -- The potential benefit to Singapore from the turmoil in Hong Kong: $4 billion.

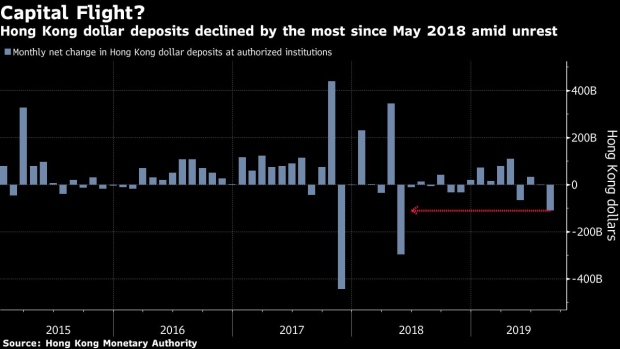

That’s the upper end of an estimate from Goldman Sachs Group Inc. of the money investors have moved to Singapore amid escalating political protests in the former British colony. The New York-based bank estimated that there has been a maximum outflow of Hong Kong dollar deposits totaling $3 billion to $4 billion to Singapore, an alternative financial center for the region, as of August.

“We found modest net outflow from HKD deposits in Hong Kong and modest net inflow of FX deposits in Singapore,” analysts Gurpreet Singh Sahi and Yingqiang Guo wrote in a note to investors late Monday. “We believe the debate on Hong Kong outflow/liquidity will remain active and the data points for September (and beyond) critical in shaping the same.”

Local-currency deposits declined in August by the most in more than a year, though the chief of Hong Kong’s de facto central bank attributed that to a dearth of initial public offerings and said there’s been a slight increase in the first three weeks of September. That was before a further escalation in violence in the city, culminating in the shooting of a protester Tuesday.

To contact the reporter on this story: Alfred Liu in Hong Kong at aliu226@bloomberg.net

To contact the editors responsible for this story: Candice Zachariahs at czachariahs2@bloomberg.net, Daniel Taub, Sam Mamudi

©2019 Bloomberg L.P.