Apr 22, 2019

Goldman Says Health-Care Options Are Showing Little Fear Amid Rout

, Bloomberg News

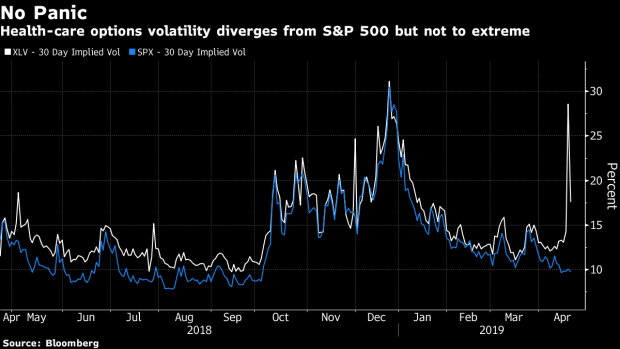

(Bloomberg) -- Given the health-care rout that’s wiped out $234 billion of market value in April, you’d be forgiven for thinking investors are panicking. Options prices show they aren’t, according to Goldman Sachs & Co.

The S&P 500 Health Care Index fell 0.4 percent on Monday, pushing its decline in April to 6.8 percent. It’s the only major industry group that has fallen this year as concerns deepen about disruptive policy proposals in Congress, including “Medicare-for-All” legislation that would replace private medical insurance with a government-run system.

While investors have been seeking health-care hedges amid the carnage, prices show no sign of extreme downside panic, according to Goldman.

Option prices for the $18.1 billion Health Care Select Sector SPDR Fund have increased over the past few days, diverging from those on the SPDR S&P 500 ETF Trust. But they’re not yet pricing in “an extreme level of fear that would be consistent with a capitulation in sentiment,” Goldman options strategists including John Marshall wrote in an industry research report issued after the market closed last week.

Last week, the average daily put volume on the Health Care Sector ETF jumped to more than three times the 20-day average.

The tactical setup is now for health-care stocks to “recover modestly where earnings are supportive,” barring any unfavorable headlines on the policy front, Goldman wrote in the note. Managed care, which bore the brunt of the health-care selloff, “should be watched closely as a potential proxy that could lead us out,” they wrote.

To contact the reporters on this story: Gregory Calderone in New York at gcalderone7@bloomberg.net;Tatiana Darie in New York at tdarie1@bloomberg.net

To contact the editors responsible for this story: Catherine Larkin at clarkin4@bloomberg.net, Richard Richtmyer, Scott Schnipper

©2019 Bloomberg L.P.