Sep 20, 2021

Goldman Says Low-Rate World Favors Quality Growth Stocks

, Bloomberg News

(Bloomberg) -- The backdrop of interest rates remaining low to aid slowing economic growth supports maintaining longer-term positions in high quality, secular growth stocks, according to Goldman Sachs Group Inc.

“The persistently low overall level of interest rates that our economists expect, and their forecast for real GDP growth that should decelerate to a below-trend pace of 1.5% by the end of next year, should continue to support profitable long duration stocks with high quality attributes,” Goldman strategists led by David Kostin, wrote in a note Friday.

Goldman strategists favor shares with good profit margins and stable earnings over the longer term such as Tesla Inc., Uber Technologies Inc. and Netflix Inc., according to a note. Short-duration stocks including eBay Inc., Cigna Corp. and Kraft Heinz Co. should tactically outperform if rates rise, they said.

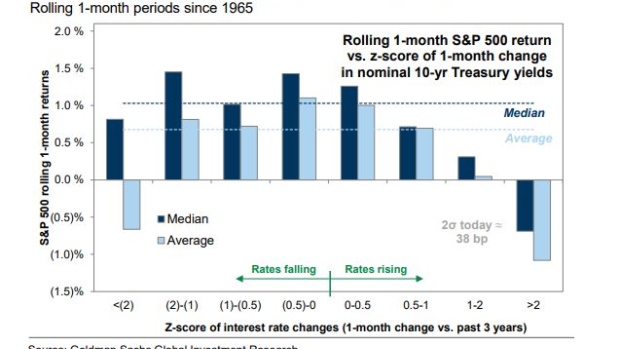

The speed and composition of interest-rate changes will be key for the equity market: equities have generated negative returns when bond yields rise by two or more standard deviations -- about 38 basis points as of now -- according to the report. The S&P 500 is also particularly sensitive to real rate shocks today as the growing weight of technology has increased the implied duration of the index, it said.

©2021 Bloomberg L.P.