Feb 19, 2019

Goldman Says Sell Taiwan Tech Bounce and Picks Some Stocks

, Bloomberg News

(Bloomberg) -- The strong performance of some technology stocks in Taiwan this year won’t last, according to Goldman Sachs Group Inc.

A combination of sluggish global growth in the first half of the year, a possible decline in tech earnings in 2019 and high foreign investment in the sector all point to likely underperformance from technology companies in Taiwan, Goldman strategists led by Richard Tang wrote in a note Monday. They said the tech bounce appears to be part of the “laggard rotation occurring in the region,” which is unlikely to last.

“On a relative basis, we recommend investors to favor non-tech, and believe that any rotation into tech may not sustain as we do not see any solid fundamental arguments,” the strategists, who are underweight Taiwan within Asia, wrote.

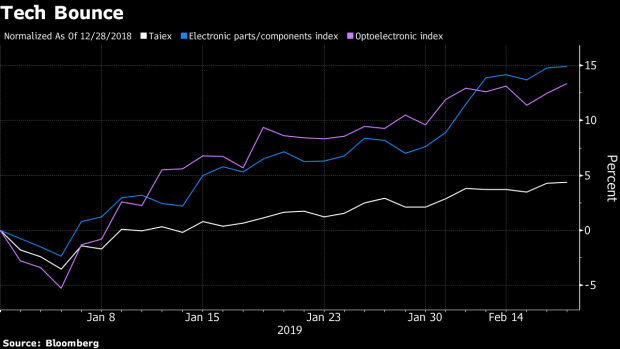

Taiwan’s Taiex index edged higher Tuesday and has risen 4.4 percent this year, with the Electronic Parts/Components and Optoelectronic indexes gaining the most among 28 industry groups. That’s a change from 2018. Goldman says the non-tech sector has outperformed tech by 30 percent since late 2017.

Companies such as CTBC Financial Holding Co. and Mega Financial Holding Co. could outperform as valuations and positioning normalize, according to Goldman, while investors should be “cautious” on firms like Nanya Technology Corp. and Asustek Computer Inc. They also recommended focusing on stocks with high dividends and low earnings volatility.

“Bottom line: we fade the tech bounce, and expect non-tech to maintain its leadership,” the strategists said.

(Updates market performance in fourth paragraph.)

To contact the reporter on this story: Joanna Ossinger in Singapore at jossinger@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Will Davies, Eddie van der Walt

©2019 Bloomberg L.P.