Oct 15, 2020

Goldman Says Tech to Lose Out to Beaten-Down Banks and Autos

, Bloomberg News

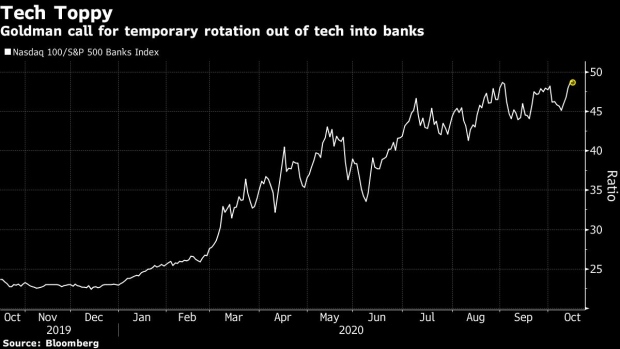

(Bloomberg) -- A barrage of policy and economic shifts will temporarily put an end to the outperformance of technology stocks and instead lift laggards such as banking and auto shares, according to strategists at Goldman Sachs Group Inc., among a chorus of investors and strategists increasingly warning of an imminent shift in market leadership.

Rising bond yields, the expectation of at least one Covid-19 vaccine approval this year and the potential of a so-called Blue Wave in November’s U.S. elections could lead to a reversal of fortunes for the sector that has been the biggest stock market winner of the pandemic so far, a team including Peter Oppenheimer wrote in a note Thursday.

The strategists cut their recommendation on technology stocks to neutral and upgraded banking and auto shares to overweight. They also lowered their view on food, beverage and tobacco stocks to underweight.

“In the next few months we expect some policy and economic shifts that support a temporary rotation; and these rotations can be quite large,” the strategists wrote. “The secular trends still favor growth or growth-defensive stocks.”

Tech stocks have soared this year as investors bet on the resilience of their earnings and the benefits of the trend of working from home, while banks have struggled as interest rates were slashed to record lows. The tech-heavy Nasdaq 100 Index is up 37% year-to-date, compared to a decline of 35% in the S&P 500 Banks Index.

The banking sector “is the most sensitive sector to rates and growth and, despite low underlying returns in recent years, we think it offers exceptional value,” the strategists wrote. “We downgrade technology to reflect our expectation of a near-term bounce in value.”

Goldman join the likes of Citigroup Inc. in tipping value shares, which have disappointed investors during the last decade.

Read more: Value Losses Lead $10 Billion Quant Trader AJO Partners to Shut

Citi’s head of U.S. equity trading strategy Alexander Altmann said at a conference in Sydney this week that the upcoming U.S. election could put value stocks in the limelight once again.

“The stories of value’s death are somewhat premature,” he said. Even though a majority of investors agree that a Biden win would support the case for the factor, a rotation into economically-sensitive stocks “is not what the market is currently positioned for, ironically.”

Read more about why Bernstein’s top quant says ‘I’m no longer a quant’

Some quantitative investors said that the stretch of gains for growth stocks puts them at risk of experiencing a “Minsky moment,” a phenomenon where a period of consistently strong returns breeds recklessness among investors that become unsustainable, and ends in a market collapse.

“When bad things don’t happen for a long time, people get more comfortable,” said George Mussalli, co-chief investment officer and head of equity research at Panagora Asset Management Inc. He expects “We don’t know what the catalyst could be, the election could be a catalyst, but nobody knows.”

(Adds comments from Citi, PanAgora Asset Management beginning in seventh paragraph.)

©2020 Bloomberg L.P.