Apr 1, 2019

Goldman sees a 'big finish' for Brexit, opportunity in the pound

, Bloomberg News

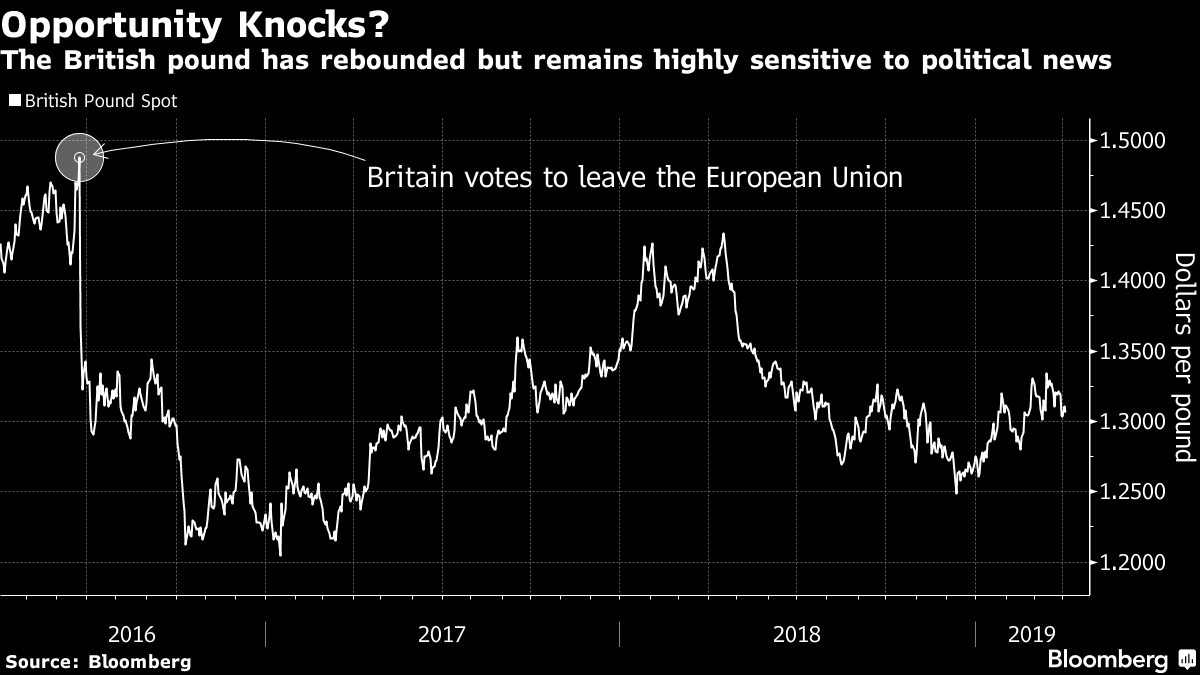

Britain’s pound presents the biggest opportunity within developed-market currencies with a probable break-the-Brexit logjam moment coming soon, according to Goldman Sachs Group Inc.

“We’re coming to a big finish here,” Zach Pandl, Goldman’s co-head of global foreign exchange and emerging market strategy, said on Bloomberg Television after the U.K. Parliament again rejected all alternatives to Prime Minister Theresa May’s unloved deal to leave the European Union. “We do think we’re making progress despite these failed votes.”

Instead of a prolonged stalemate or a chaotic no-deal scenario, Pandl said a soft Brexit approach, which may include a permanent customs union packaged with a second referendum, could come within the next day or two.

“Sterling is maybe the biggest opportunity among developed market exchange rates today,” Pandl said. The pound was at US$1.3066 as of 9:49 a.m. in Hong Kong, at the weaker end of its recent range.

Parliament rejected a proposal to stay in the EU’s trading arrangement , known as the customs union, by just three votes. It could potentially be voted on again Wednesday.

Separately, Goldman has closed its short recommendation on the U.S. dollar against the Japanese yen, Pandl said.

“We think we’ve seen enough data to indicate that the global industrial cycle at least on the margin is picking up,” Pandl said. “It’s a little bit too risky to be betting on yen appreciation over the short run.”

--With assistance from Haidi Lun.