Aug 9, 2022

Goldman Sees Global M&A Volumes Defying Souring Credit Conditions

, Bloomberg News

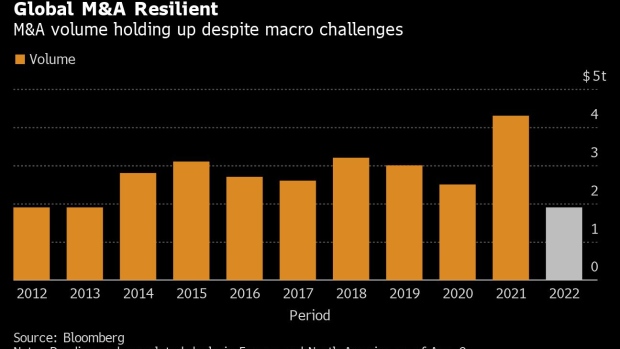

(Bloomberg) -- Global dealmaking is proving surprisingly resilient to a toxic mix of higher funding costs, slumping management confidence and a raft of economic challenges, according to a Goldman Sachs Group Inc. strategist.

Merger and acquisition activity has held up well this year, despite a less favorable funding environment, Sienna Mori wrote in a note, while pointing out that global volumes have come off 2021’s record highs. Even in a traditionally quieter summer period, $22.1 billion worth of takeovers were announced on Monday alone, data compiled by Bloomberg show.

A cocktail of rising rates, slowing growth and fears of a looming recession put a huge strain on lending markets, spurring banks and private credit providers to dial back on risk. Companies have been putting excess money raised during the pandemic to work, funding more deals through cash rather than debt.

“The resilience of M&A appetite in the face of elevated macro risks suggests that managements remain focused on one of the many key lessons of the pandemic: The importance of strengthening and diversifying business mixes in order to withstand large macro shocks,” said Mori.

Private equity buyers in particular have been using cash reserves to fund deals. Leveraged buyouts have picked up sharply from a slow start to the year and are on track to match last year’s levels, she said. Monday’s deal flurry includes Vista Equity Partners proposed purchase of tax-management software provider Avalara Inc. and Pfizer Inc.’s agreement to buy Global Blood Therapeutics Inc.

©2022 Bloomberg L.P.