Jul 25, 2022

Goldman Warns China’s Property Crisis Will Sink Iron Ore Prices

, Bloomberg News

(Bloomberg) -- The crisis engulfing China’s property sector will help swing the iron ore market to a significant surplus over the second half of the year and push prices sharply lower, according to Goldman Sachs Group Inc.

The bank now projects an excess of 67 million tons of the steelmaking mineral for the rest of 2022, after a deficit of 56 million tons in the first half, reflecting both weakness in onshore real-estate and a sharp deceleration in steel demand outside China, according to a note on Tuesday.

Goldman also cut its three and six month price targets to $70 and $85 a ton, respectively, from $90 and $110 a ton. Iron ore futures in Singapore last traded around $107 a ton. The bank said it expects the iron ore market’s current predicament to outlast the sell-off seen in 2021, although conditions are unlikely to get as bad as the 2014-15 bear market, which saw prices hit a low of $38 a ton.

The issue at hand is that iron ore is closely linked to early-cycle property activity in China, Goldman said. The government’s crackdown on excessive debt in the sector, which began about year ago, has morphed into a full-blown crisis, with mortgage holders now withholding payments on unfinished housing.

“This sector segment generates close to a third of China’s steel and iron ore demand, which in turn represents close to a quarter of global seaborne demand,” Goldman said.

Bloomberg Intelligence has a similar take on the impact of the crisis on commodities markets. Among metals, steel may be hurt most in the third quarter by the mortgage boycott, as construction broadly accounts for 49% of Chinese demand. For aluminum, the proportion is 32%, and for copper it’s 9%.

Investors hoping that Beijing will ride to the rescue of developers caught up in the mortgage crisis are likely to be disappointed, said Bloomberg Economics, as “the government will be loath to offer anything resembling bailouts that could encourage moral hazard.”

Events Today

(All times Beijing unless shown otherwise.)

- China Methane Forum seminar on the oil & gas industry, 13:30

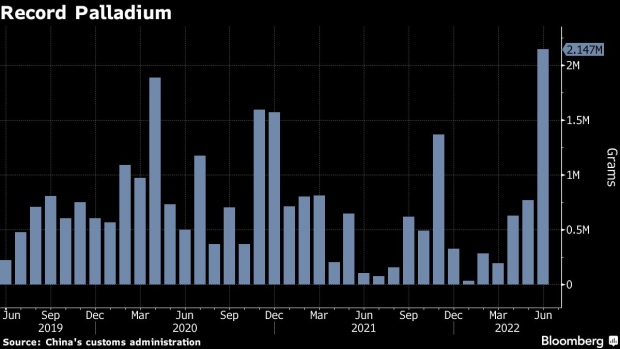

Today’s Chart

China’s palladium imports from Russia rose to a record high in June. The world’s biggest miner of the precious metal is rerouting shipments as many of its usual customers shun its goods following the invasion of Ukraine.

On The Wire

- China’s Gotion High-Tech Said to Raise $685m in Swiss GDR Sale

- China Should Add More Industries to Carbon Trading Market: Daily

- China Aluminum Smelter Margins Likely to Narrow on Rising Costs

- China’s Coal Giant Boosted Spending 51%, Output 6.2% in 1H

- Global Grain Prices to Have Little Impact on China CPI: Report

- LG Energy, Huayou Cobalt to Create Battery Recycling JV in China

- China Property Crisis, Waning Construction to Dent Metals Demand

- Iron Ore Flows: Brazil Ships 1.52 M T/Day in 16 Days of July

The Week Ahead

Wednesday, July 27

- China industrial profits for June, 09:30

- China session at WoodMac’s Power & Renewables Conference in Singapore

Thursday, July 28

- Fortescue quarterly production report

Friday, July 29

- China weekly iron ore port stockpiles

- Shanghai exchange weekly commodities inventory, ~15:30

Saturday, July 30

- Nothing major scheduled

Sunday, July 31

- China official PMIs for July, 09:30

©2022 Bloomberg L.P.