Dec 19, 2022

Grayscale Considers Tender Offer for Bitcoin Trust Fund If SEC Lawsuit Fails

, Bloomberg News

(Bloomberg) -- Grayscale Investments is considering appealing to the same US regulator that it’s currently suing for permission to buy back shares of its heavily discounted Bitcoin trust should the firm’s lawsuit fail.

A tender offer for up to 20% of the outstanding shares of the $10.7 billion Grayscale Bitcoin Trust (ticker GBTC) is one of the options that the digital asset manager is considering, Grayscale Chief Executive Officer Michael Sonnenshein wrote in a letter to investors Monday. That process, in which Grayscale would ask shareholders to sell back their GBTC shares at an agreed price, would require approval from the Securities and Exchange Commission that the agency “may not provide,” Sonnenshein wrote.

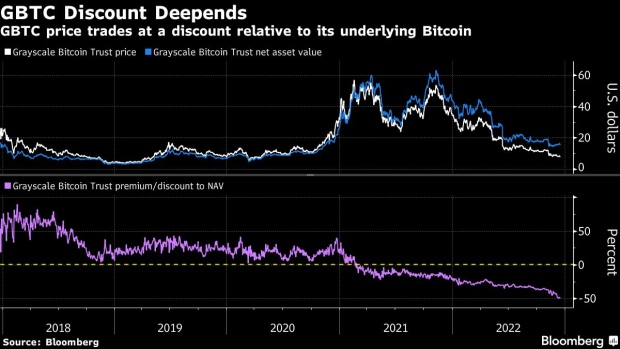

GBTC closed nearly 50% below the value of its underlying Bitcoin on Friday, Bloomberg data show. Unlike an exchange-traded fund, GBTC can’t redeem shares to keep pace with cooling demand, which has seen the dislocation widen to record levels in recent weeks as the trust sells off to a greater degree than Bitcoin itself. The SEC denied Grayscale’s attempt to convert GBTC into a physically backed Bitcoin ETF in June, citing that the plan by NYSE Arca to list the product didn’t do enough to prevent fraud and manipulation. Grayscale filed a lawsuit against the agency within hours.

The lawsuit, combined with GBTC’s relatively hefty 2% annual fee, has spurred a backlash. Hedge fund Fir Tree Capital Management sued Grayscale earlier this month for information to investigate potential mismanagement and conflicts of interest of the trust. Fir Tree, which manages $3 billion, wants to push Grayscale to erase the discount by lowering fees and resuming redemptions, people familiar with the hedge fund’s plans told Bloomberg News.

The Grayscale letter lands as questions around the health of parent company Digital Currency Group swirl. The once-$10 billion conglomerate founded by Barry Silbert also owns crypto lender Genesis, which suspended withdrawals last month and is reportedly seeking to raise fresh capital to stave off bankruptcy.

Currently, liquidating GBTC isn’t being considered, Sonnenshein said.

“In the event we are unsuccessful in pursuing options for returning a portion of the capital to shareholders, we do not currently intend to dissolve GBTC, but would instead continue to operate GBTC without an ongoing redemption program until we are successful in converting it to a spot Bitcoin ETF,” Sonnenshein wrote.

©2022 Bloomberg L.P.