Apr 15, 2021

Greece a Top Beneficiary From EU Crisis Fund, Exchange Head Says

, Bloomberg News

(Bloomberg) -- Greece expects to be one of the big winners from the European Union’s Recovery and Resilience Facility and investors are already aware of the advantages for the country, Athens Stock Exchange Chief Economic Officer Socrates Lazaridis said in an interview.

“Both the base effect and the dynamic outlook presented by the RRF -- not only in terms of funds but also in terms of preparation and management compared to the rest of Europe -- explain investors’ current interest in the Greek stock market,” Lazaridis said.

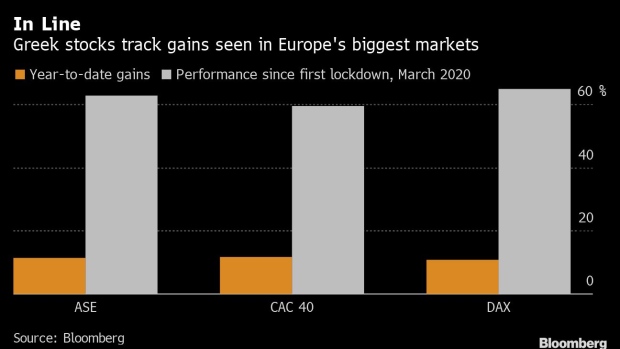

Athens’ main ASE is up 12% since the beginning of the year and around 63% since the country’s first lockdown started in March 2020.

“We see investor interest focusing on IT, telecommunications, real estate, energy and food and beverage, as well as banks,” Lazaridis said. “We’re exploring whether there’s merit to adding feature products for these sectors.”

Greece is set to receive 32 billion euros ($38 billion) from the recovery fund and the government has said that more than 37% of grants will be directed to green projects, with the remainder going to digital transition, investment and employment, training, and social cohesion measures.

Investors are focusing in particular on energy companies at the moment given momentum in European funds, Lazaridis said.

European funds could provide a major boost to the Greek economy, which lost some 25% during its decade-long debt crisis and an additional 8.2% last year due to the pandemic.

The exchange is also working to create a new environmental, social and corporate governance index to help investors spot the best performing companies in these fields, Lazaridis said.

“Participation in the index will be based on companies’ sensitivity on providing the investment community with information about ESG activity,” he said. The index is expected to be ready by October.

©2021 Bloomberg L.P.