Sep 17, 2020

Green Bonds Should Have Green Strings Attached

, Bloomberg News

(Bloomberg Opinion) -- The bond market is finally finding its conscience. Egged on by investors, companies and countries are rushing to sell debt billed as helping to combat climate change or advance social goals. The impending arrival of the European Union in this area is an opportunity to address some of its early flaws.

While greater environmental awareness is to be welcomed, linking it to finance requires a coherent structure. The idea behind these bond sales is that the proceeds are, at least partly, tied to action on sustainability. But the existing protocol — contained in tentative guidelines from trade body the International Capital Markets Association — allows plenty of room for interpretation. It would be better if there was a requirement for measurable results, instead of just painting debt in a different color.

Covid-related and social-impact debt guidelines are particularly vague. While investors can push back on deals with flaky credentials, the job of vetting such sales probably shouldn’t be left to the market.

The incentive to issue so-called green bonds is becoming clearer as surging investor demand makes them an increasingly cheap form of financing. Germany sold a “green” 10-year bund earlier in September. This now trades at a premium to the existing August 2030 benchmark which is identical in every other respect.

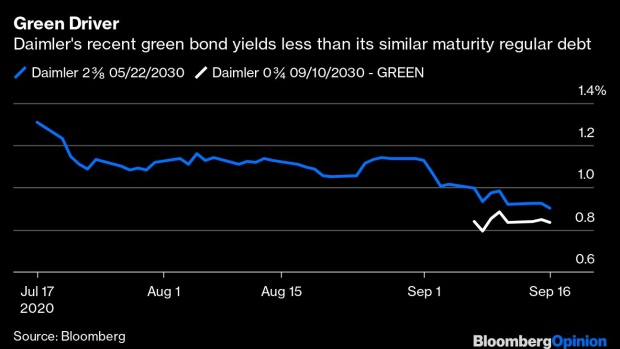

That sale also encouraged German corporates to get in on the act. Daimler AG followed with a similar instrument that priced 13 basis points lower in yield than the carmaker’s existing debt of similar maturity. Likewise, Volkswagen AG sold eight-year and 12-year green benchmarks on Wednesday, around 14 basis points lower in yield versus the rest of its bonds. Over time this will become a significant saving for Europe's biggest corporate issuer, but shouldn’t it come with greater accountability?

So investors will pay a premium — or rather "greenium" — to own these instruments. The green carrots are there. There also need to be some green sticks.

A couple of recent deals point to the way forward. Take Wednesday’s eight-year sustainability-linked 1.9 billion-euro ($2.2 billion) deal from Novartis AG. It has an important feature — a potential 25-basis-points hike in the annual coupon in the last three years of the bond’s life. That would kick in if the pharma giant misses targets for increasing patient access in low-income countries by 2025. Last week, Brazilian paper company Suzano SA sold 10-year bonds in dollars with a similar penalty if emission targets are not hit.

It can't be too much of a stretch for Europe to devise a regulatory framework imposing conditions on any new environmental, social and corporate governance (ESG)-related bonds, and to penalize any issuer that falls short of its stated prospectus aims.

The EU is making green and social bonds a cornerstone of its pandemic Recovery Fund — with 225 billion euros planned, this will make it the undisputed green bond king, as this matches the total amount of green bonds globally last year. With the bloc yet to confirm its own guidelines on such debt, surely there is no better time to provide some clear leadership.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Marcus Ashworth is a Bloomberg Opinion columnist covering European markets. He spent three decades in the banking industry, most recently as chief markets strategist at Haitong Securities in London.

©2020 Bloomberg L.P.