Aug 19, 2019

Greene King Banishes Brexit Blues With Some Help From Hong Kong

, Bloomberg News

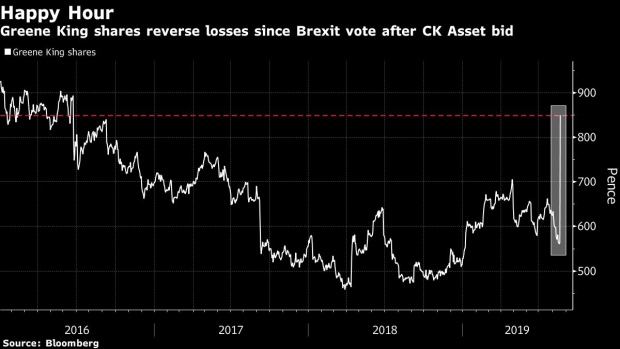

(Bloomberg) -- The day after the U.K.’s 2016 Brexit vote, Greene King Plc shares slumped below 850 pence. They’ve struggled to reach that level until now.

The stock surged 51% on Monday to the highest point since the Brexit referendum in June 2016, after Hong Kong’s CK Asset Holdings Ltd. agreed to buy the British brewer for 850 pence a share in cash. That values the U.K. company at about 2.7 billion pounds ($3.3 billion).

CK Asset’s bid for Greene King follows private equity firm TDR Capital’s agreement to buy U.K. pub-chain operator EI Group Plc for about $1.6 billion in July.

To contact the reporter on this story: Lisa Pham in London at lpham14@bloomberg.net

To contact the editors responsible for this story: Beth Mellor at bmellor@bloomberg.net, Jon Menon, John Lauerman

©2019 Bloomberg L.P.