China Home Prices Fall as Slump Shows Few Signs of Abating

China’s home prices continued to fall in March, adding pressure on authorities to step up efforts to support the embattled real estate market.

Latest Videos

The information you requested is not available at this time, please check back again soon.

China’s home prices continued to fall in March, adding pressure on authorities to step up efforts to support the embattled real estate market.

PricewaterhouseCoopers LLP said it will investigate an anonymous letter circulating on social media that made “false allegations” about the company and its partners over its role in auditing China Evergrande Group.

A Hong Kong bank has filed a request for a court to wind up Chinese developer Times China Holdings Ltd., marking another case where a lender has actively pursued liquidation of a distressed builder.

New York lawmakers agreed to the most sweeping changes in New York housing policy in years in a $237 billion budget deal, Governor Kathy Hochul said Monday.

The long-concealed market value of Tokyo’s largest skyscrapers is being unveiled by activist investors.

Jan 20, 2022

, Bloomberg News

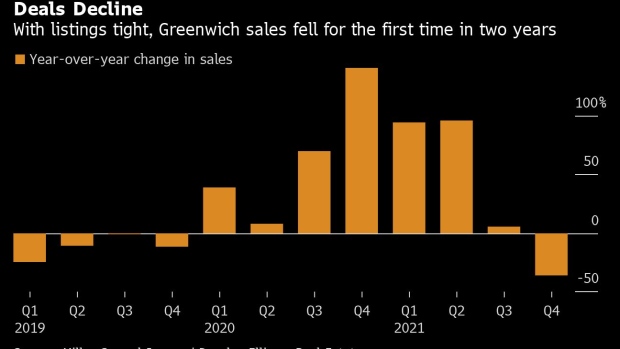

(Bloomberg) -- Greenwich home listings plunged to a record low in the fourth quarter, putting the brakes on a buying frenzy in the posh Connecticut town.

There were just 167 single-family houses available at the end of the quarter, down nearly 65% from before the pandemic and the fewest in data going back eight years, according to a report Thursday by appraiser Miller Samuel Inc. and brokerage Douglas Elliman Real Estate.

Purchases fell 36% from a year earlier -- the first time since the market began to heat up in 2019 that the dwindling supply has hurt sales, according to Jonathan Miller, president of Miller Samuel. But the number of houses that changed hands, 181, was still well above the town’s historical fourth-quarter average.

The Covid-era dash to the suburbs has made Greenwich -- a 45-minute train ride to midtown Manhattan -- one of the hottest housing markets in the New York area. While demand remains fierce, the stock of available homes has declined for 10 straight quarters, leaving supplies critically depleted, according to Miller.

Read More: Suburban NYC Home Sales Plunge Because There’s Nothing to Buy

“Inventory is not low, it’s insanely low,” Miller said. Even if a substantial number of sellers listed their homes in the first half of the year, the supply would still be tight, he said.

At the current pace of deals, it would take just 2.8 months to sell all the single-family houses on the market at the end of the quarter, down from 3.4 months a year earlier, according to the report.

The median price of houses that changed hands in the quarter jumped 9.8% from a year earlier to $2.25 million. And bidding wars were common: One out of three purchases closed above the asking price, according to Miller.

©2022 Bloomberg L.P.