Jun 1, 2023

Growing Climate Tech Firms Need Engineers — But Also Sales and HR Pros

, Bloomberg News

(Bloomberg) -- Since the start of 2023, more than 700 tech companies around the world have laid off a total of almost 200,000 employees. Tech employment in the US, however, was as of late March still about 7% above its level before the pandemic. And for tech workers who want to put their skills to use outside their traditional fields, climate companies are hiring across the board.

Global hiring and networking site Climatebase has posted more than 46,000 jobs from over 1,500 organizations (both for- and not-for-profit) over the past two years. Certainly, highly technical jobs related to the science of climate mitigation and adaptation are in high demand. But so too are roles familiar from any global business. It is mostly these roles that climate tech firms seek to fill, according to data that Climatebase shared with Bloomberg Green.

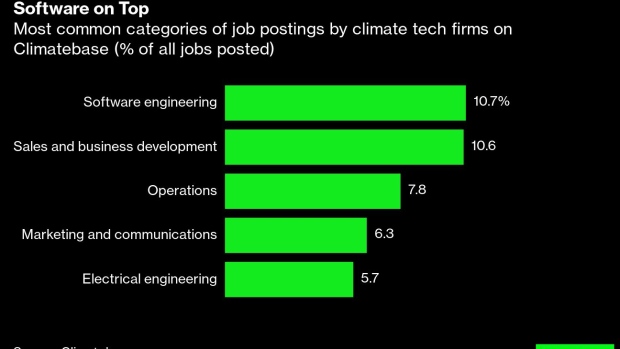

Across all the job postings shared on the site from Jan. 1, 2021 through May 14, 2023, the single most in-demand category was software engineering. But the next three were more general in nature: sales and business development, operations and marketing and communications.

The fifth was electrical engineering. If we consider the fact that software and electrical engineering are both quite general as technical roles are concerned, then none of the job roles that are in highest demand in climate tech are necessarily climate-specific.

At least a quarter of all job ads on the site have been for roles that are highly interchangeable not only across companies, but across sectors. However, there are still important distinctions among key hiring regions in the US.

In California, software engineering is the most in-demand kind of role. In Texas, it’s sales and business development, while in New York it’s operations. California stands out as an engineering-heavy jobs market, with mechanical and electrical engineering also making the state’s top five.

There are also sector-specific distinctions within climate tech. Transport-related businesses, and those specializing in food and agriculture, seek software engineers above all. But in the energy, buildings and carbon removal sectors, operations talent is most in demand. Distinct categories pop out in some sectors’ listings: Human resources ranks fifth for food and agriculture, while for buildings, design comes fifth.

Key jobs may be in demand across climate companies, but that doesn’t mean they’re easy to fill. Hiring for engineering roles, whether software, mechanical or electrical, takes at least three months, according to Climatebase. Human resources jobs take 100 days to fill on average. The hardest roles to fill? Data science and analytics, which take an average of nearly four months.

The picture this data paints is nuanced. Different sectors have some key in-demand skills, as do specific regions of the US. Analytics and software roles are hard to fill, universally — and so for that matter are human resources jobs. But more important than the differences in what climate tech firms are looking for in their hiring pool are the similarities. Software engineering experience is needed everywhere; so too is operational expertise.

This should be heartening news to those hoping to break into climate tech. Deeply technical skills are essential for founding deeply technical companies. But growing those companies demands the same general business roles, and skills, that any successful enterprise does.

Nat Bullard is a senior contributor to BloombergNEF and writes the Sparklines column for Bloomberg Green. He advises early-stage climate technology companies and climate investors.

©2023 Bloomberg L.P.