Dec 14, 2021

Gwyneth Paltrow-Backed Crypto Miner TeraWulf Tumbles in Debut

, Bloomberg News

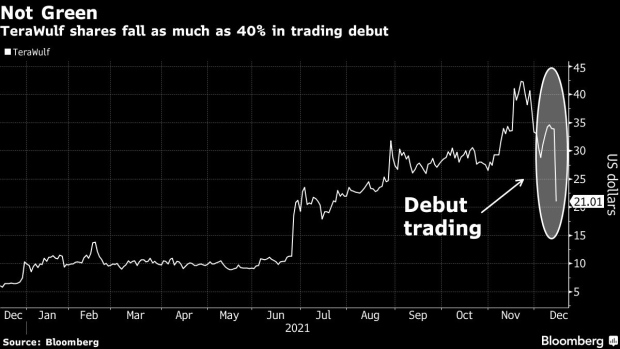

(Bloomberg) -- Shares of TeraWulf Inc., the cryptocurrency miner that recently touted the backing of celebrity investors including Gwyneth Paltrow, slumped as much as 40% during the company’s public trading debut on the Nasdaq stock market.

The firm, which strives to provide more environmentally-friendly processing of crypto transactions, went public after completing a merger with imaging-technology company Ikonics. The stock dropped as low as $20.02 after being listed at $25.

The slump comes amid a broader drop in the shares of other cryptocurrency miners, which use massive amounts of computing power while competing to win freshly minted tokens for processing transactions. The quantity of electricity used is equal to the amounts by some nations.

Crypto mining stocks have been “hard hit” following the sharp selloff in Bitcoin prices and concern of falling profitability, said Chris Brendler, an analyst covering the industry at DA Davidson & Co., with the so-called hash rate or the speed of mining back to highs unseen since China took their rigs offline.

“Profitability has fallen dramatically. The price of Bitcoin going down and global hash rate going up means bad news for miners,” Brendler said.

©2021 Bloomberg L.P.