(Bloomberg) -- H2O Asset Management co-founder Vincent Chailley defended his firm’s “deep value debt” in a video posted on its website Friday, referring to the unlisted bonds that have triggered mass investor redemptions, contributing to an almost 8 billion-euro ($9.1 billion) slide in assets. H20 won’t sell unless there’s an attractive bid, he said. It’s also planning to set up a new fund specializing in “deep value” securities.

What exactly is ‘deep value’?

In its simplest form, deep value investing means buying assets whose market price is below their intrinsic value. Warren Buffett is the world’s most famous "value investor" because he buys companies that he thinks have underappreciated attributes and is willing to own them for years. Hedge funds try to do a similar thing using a range of financial instruments.

For investors like H20 who specialize in the debt market, making serious money means identifying bond bargains because the upside is limited to the face value of the security. Some managers like Blackstone Group’s GSO specialize in buying the debt of distressed companies that they expect will recover or be converted into new equity on more favorable terms.

“I like the saying, ‘there’s no good or bad assets, there are only good or bad prices’,” said Keith Tomlinson, who runs a London-based research company that reviews money managers’ strategies.

In H20’s concept of ‘deep value debt’, it allocated more than 1 billion euros to bonds issued by European companies connected to the controversial German financier Lars Windhorst.

“We love swimming against the tide in order to add value,” Chief Executive Officer Bruno Crastes said in the video. “We must be prepared to go where others don’t in order to excel.”

In fact, other investors have been there before. Italian insurer Assicurazioni Generali SpA was among those that sued Windhorst to recover money after failed investments in 2016, while BlueBay Asset Management has exited holdings tied to his companies this year.

What are H2O’s ‘deep value’ positions?

La Perla, an Italian lingerie maker that lost 110 million euros on 134 million euros of sales in 2017, is one. The H2O-Windhorst relationship has vexed analysts and rating agencies who cover the asset manager backed by Natixis SA, the French bank. “The concentration of investments on companies owned by one sponsor questions H2O’s risk management policies,” Fitch Ratings Ltd said in a report Friday.

Here are the Windhorst-linked bonds that H20 owns or has owned until recently:

H2O says these securities are more valuable than the levels it’s been forced to mark them down to and it won’t dispose of the bonds until they can get a higher price.

“We believe in the value of our private debt security,” H2O’s Chailley said.

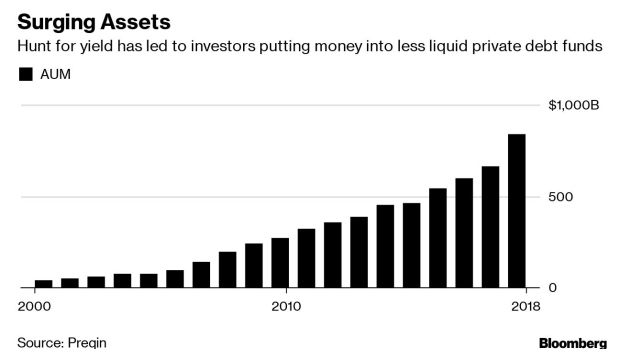

Private debt is a booming segment of capital markets in the U.S. and Europe. Asset managers are raising billions for funds that lend to companies, displacing traditional banks that have retrenched since the financial crisis. Such funds raised more than $100 billion in each of the last four years, while total assets under management rose to a record $837 billion last year, according to data compiled by Preqin, a data provider. It’s unusual for private debt to be held by open-ended funds like H20’s Allegro and Multibonds funds.

The positions that Chailley described as private debt are technically public bonds because they’ve been packaged into securities with serial codes known as ISINs.

Private debt is harder to trade than bonds, though analysts have questioned whether they actually resemble loans with H2O “acting as a quasi-bank,” according to Autonomous Research. The distinction matters because at the present H20 funds are not permitted to hold loans.

What is H20 planning next?

The firm hasn’t outlined a timeline or said how the new "deep value" fund will be structured, but if it buys assets as thinly traded as the Windhorst bonds, then it will be trickier to offer investors the daily liquidity that is available in other H20 funds.

H20’s Allegro and Multibonds funds, which hold the Windhorst notes, have lost more than one third of their assets since June 18 as investors tapped their daily option to redeem money. Crastes said in the video that the funds have “never gated and we will never gate,” referring to actions taken by other managers this year who were forced to shut the door on those trying to retrieve their money.

A spokesman declined to comment on whether the new deep value fund will own the Windhorst notes.

H2O’s CEO Vows Never to Gate Funds Avoiding Woodford Comparisons

--With assistance from Lucca de Paoli.

To contact the reporters on this story: Thomas Beardsworth in London at tbeardsworth@bloomberg.net;Nishant Kumar in London at nkumar173@bloomberg.net;Luca Casiraghi in London at lcasiraghi@bloomberg.net

To contact the editors responsible for this story: Vivianne Rodrigues at vrodrigues3@bloomberg.net, James Hertling

©2019 Bloomberg L.P.