May 16, 2019

Hate Globalization? Then Embrace Stagnation

, Bloomberg News

(Bloomberg Opinion) -- Economists traditionally have thought that long-term productivity growth is due to technological and organizational improvement. Engineers learn how to make a better car engine, businesspeople figure out how to organize their work teams more efficiently, and so on. These ideas accumulate and since little gets forgotten -- barring resource exhaustion, environmental degradation or major policy mistakes -- humanity gets richer and richer.

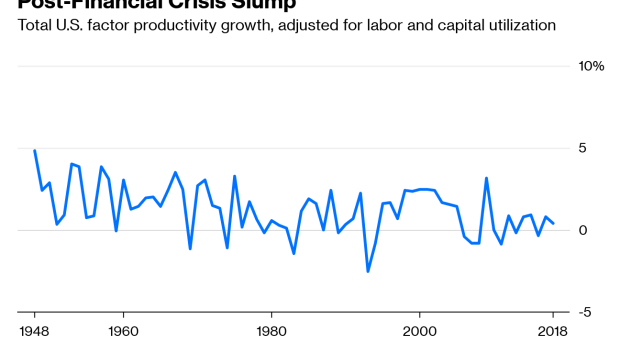

Since the mid-2000s, the U.S. has been experiencing a slowdown in productivity growth:

Although it’s difficult to compare across countries, due to differences in the way data are reported, the slump looks like a worldwide phenomenon. Even China has been growing more due to physical investment than to productivity gains since the financial crisis. The world economy has largely recovered from the Great Recession in terms of employment, but productivity remains sluggish.

Because economists so often equate productivity with technology, there’s a tendency to interpret this as a slowdown in the rate of new inventions. Robert Gordon of Northwestern University has been the most prominent exponent of this thesis.

But there was at least one other major global shift that happened in the late 2000s. The global financial crisis seems to have halted and reversed a long-running trend toward more globalization. From 1993 to 2008, trade became more and more important to the world economy:

This rapid globalization was the result of confluence of factors -- innovations such as containerized shipping and the internet, as well as political developments like the end of the Cold War and a drop in the use of protectionist policies. But as the graph above shows, the pace of world trade slowed a lot when the economy crashed. In addition to physical globalization, financial globalization also has slowed.

Could the slowing of globalization have something to do with the productivity slowdown? Research gives a number of reasons to think it might.

First of all, studies indicate a number of ways that globalization might raise the productivity of individual companies. A 2010 literature review by economists Kazunobu Hayakawa, Tomohiro Machikita and Fukunari Kimura lists many of mechanisms. Globalization can encourage foreign direct investment that leads to more efficient allocation of capital across borders, and helps technology spread from country to country. It can push companies to leave their comfortable, familiar domestic market and start exporting, which in turn pushes them to increase efficiency and gives them a better understanding of their own specialization. Or it can threaten companies with import competition, forcing them to improve or die. Globalization can push inefficient companies out of the market altogether. Or it can enhance super-productive regional industrial clusters -- auto manufacturers in Tianjin, China, or software companies in Silicon Valley.

Offshoring has become a bit of a dirty word in the U.S. Politicians and pundits denounce companies every time they move factory jobs from the Midwest to Mexico or China. And in some respect, with good reason -- the vast surge in import competition from China dealt a severe blow to American manufacturing workers, especially in the Midwest and South. But at the same time, offshoring was probably a driver of productivity growth and thus economic expansion.

In a recent paper, economists Andrew Bernard, Teresa Fort, Valerie Smeets and Frederic Warzynski show that when companies start offshoring, they tend to reorganize their workforces, employing fewer manufacturing workers and more service workers. They also tend to do more research and development and invent more products. Other studies have found a correlation between offshoring and productivity growth in Japan, Belgium, Spain, Denmark the U.S. and elsewhere.

Studying individual companies, of course, doesn’t necessarily give conclusive answers about how offshoring and globalization affect economy-wide productivity. This question is very difficult to answer, since globalization is a phenomenon that affects all countries simultaneously. But theory suggests that the free movement of capital across countries allows more productive worldwide networks of production to replace less productive regional ones. That’s in addition to the well-known phenomenon of trade allowing countries and regions to specialize in their comparative advantages. If anything, the macroeconomic gains from trade probably augment the company-level productivity increases.

So although offshoring and globalization were disruptive and painful for many, especially for manufacturing workers in rich countries, that might have been necessary to keep rapid productivity growth going. And with the rise of the U.S.-China trade war, and multinational companies’ scramble to shift their supply chains out of China, globalization’s pause seems likely to continue. The developed world agonized about offshoring, but it might now have the chance to decide whether it likes the alternative -- a stable but stagnant global economy.

To contact the author of this story: Noah Smith at nsmith150@bloomberg.net

To contact the editor responsible for this story: James Greiff at jgreiff@bloomberg.net

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Noah Smith is a Bloomberg Opinion columnist. He was an assistant professor of finance at Stony Brook University, and he blogs at Noahpinion.

©2019 Bloomberg L.P.