Jun 25, 2021

Haters everywhere in stock market after S&P 500's big first half

, Bloomberg News

The biggest advantage investors can have at the moment is flexibility: Rabobank market strategist

People were already worried about equities six months ago. Now, after the S&P 500 Index defied everything from nosebleed valuations to inflation to post one of the best first halves ever, they’re downright paranoid.

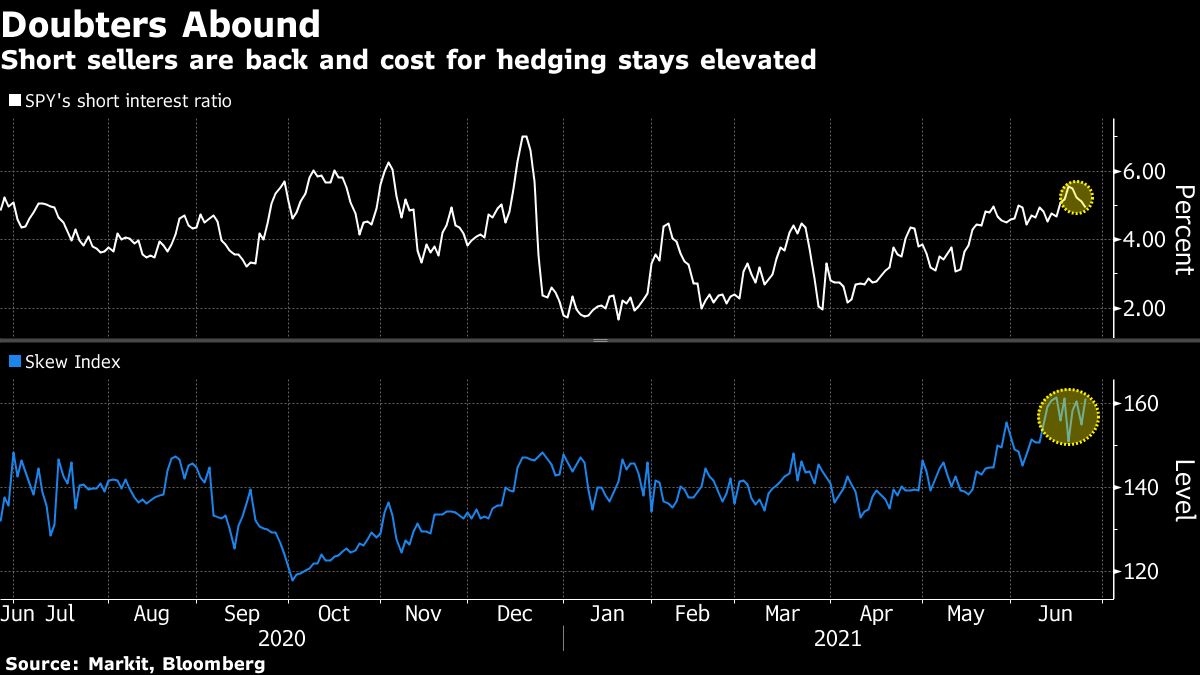

Wall Street strategists, never ones to restrain their enthusiasm when it’s warranted, warn that the gains have played out. Short sellers are circling, with wagers against the largest equity exchange-traded fund rising to the highest level this year. Star investors like Michael Burry have warned of the "mother of all crashes" in meme stocks.

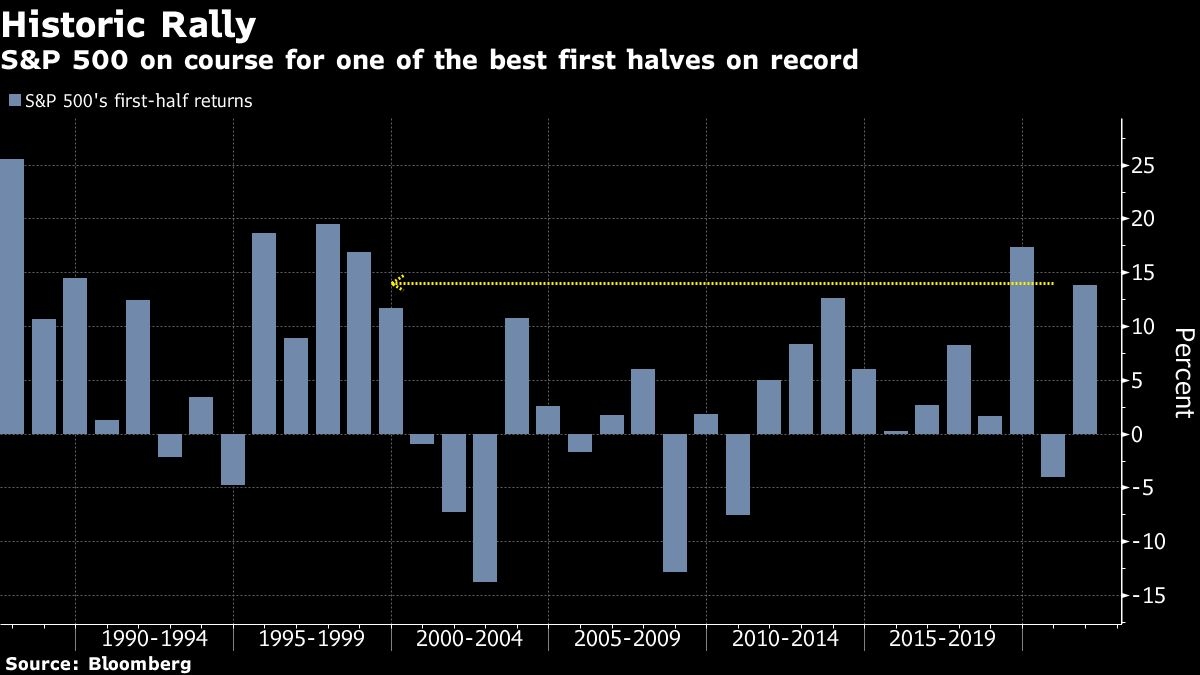

And yet, from reversals in speculative names to a hawkish shift in Federal Reserve policy, things that could have put an end to last year’s rally in equities have failed to. Instead, amid steadfast retail buying, about US$6 trillion has been added to equity values in 2021, with the S&P 500’s 14 per cent rally putting it on course for its second-best January through June period since 1998.

"The inflows of money are still so good," Mike Wilson, chief U.S. equity strategist at Morgan Stanley, said in an interview on Bloomberg TV and Radio. "The money does not leave the market. It just looks for another place to go."

While bears are getting bolder, the bulls have history on their side. In the 27 years when gains in equities were this strong through the first six months, three-quarters of the time stocks continued to march higher by December.

The S&P 500 climbed for the fourth week in five as President Joe Biden’s bipartisan US$579 billion infrastructure deal revived leadership in economically sensitive shares like banks and energy. The Russell 2000 Index of small-caps jumped more than 4 per cent, the most since March, while the tech-heavy Nasdaq 100 advanced for six straight weeks, the longest winning streak in five months.

Valuations that started the year at 23 times earnings -- near the highest since the dot-com era -- have shrunk, thanks to the fastest profit expansion in a decade. Nevertheless, at 21, the current reading is still above the five-year average of 18. Moreover, this quarter likely marks the peak of a profit recovery from the pandemic recession, with forecast growth slowing from 63 per cent now to 4 per cent early next year.

Throw in the threat of tax hikes and Fed tapering, and it’s not hard to see why Wall Street strategists call for caution. Their average year-end target tracked by Bloomberg stood at 4,213, a 1.6 per cent decline from the index’s last close.

Burry, who rose to fame on his winning mortgage bets from the 2007-2008 housing crash, joined the chorus this month, issuing a series of tweets warning individual investors about losses "the size of countries" in the event of crypto and meme-stock declines.

Short sellers, almost driven into extinction amid an equity rally and January’s short squeeze, are reloading. Bearish bets on the SPDR S&P 500 ETF have climbed to 5 per cent of its stock outstanding, from less than 2 per cent at the start of this year, according to IHS Markit data. Meanwhile, demand for protection against losses in coming months is rising in the options market.

"You’ve got a market that has kind of run ahead of itself," said Kevin Caron, portfolio manager for Washington Crossing. "Now it’s more likely you’re going to get some volatility in the market for the next six months or so until earnings and fundamentals fill in under stock prices which have become quite rich."

Yet pushing against the wall of worries are the growing numbers of retail traders who bought the dip during the pandemic bear market and have since become the staunchest allies of this bull market. A week ago, when the S&P 500 dropped more than 1 per cent, retail investors poured a record US$2 billion into equities, according to data compiled by Vanda Research.

And there is no indication they’re retreating soon. According to a report by investment adviser Betterment LLC, 58 per cent of the 1,500 day traders surveyed plan to trade even more as pandemic restrictions are lifted. Only 12 per cent said they expect to trade less.

Goldman Sachs Group Inc. strategists led by David Kostin raised their forecast for households’ net equity purchases for the full year to US$400 billion from US$350 billion after Fed data showed robust buying from the group.

"The trade-off households face between equities and other asset classes favors equities through year-end given anemic money market and credit yields," Kostin wrote in the note. "Additionally, any signs of a sustained increase in inflation would favor equities over bonds or cash."

--With assistance from Claire Ballentine.