Jan 22, 2020

Hedge Fund Outflows Neared $100 Billion in 2019, Most Since 2016

, Bloomberg News

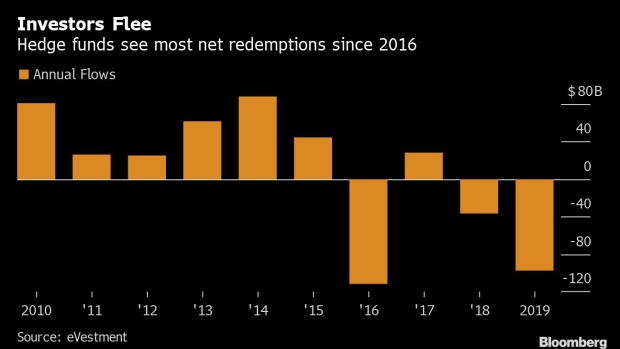

(Bloomberg) -- Hedge funds suffered almost $98 billion in outflows in 2019, the most in three years, as managers trailed the stock market rally.

Investors pulled more than $16 billion from the industry in December alone, capping a year that saw the longest stretch of monthly client withdrawals since the 2008 financial crisis, according to data compiled by eVestment. The redemptions equal about 3% of industry assets and are almost triple the $37.2 billion in outflows seen in 2018.

Hedge funds are under pressure as investors revolt after years of high fees and lackluster performance. Closures have outpaced openings in a difficult fundraising environment, and marquee names including billionaire Louis Bacon have shut funds or returned client capital.

The spike in redemptions came as the industry lagged behind the S&P 500 Index, which returned 31% last year with dividends reinvested. Hedge funds on average gained 9.2%, according to data compiled by Bloomberg.

Even the year’s top-performing strategy, equity funds, ended 2019 with outflows of $27.5 billion. Two strategies to see inflows were event-driven and mortgage-backed securities, bringing in $16.5 billion and $10.9 billion for the year, respectively.

To contact the reporter on this story: Melissa Karsh in New York at mkarsh@bloomberg.net

To contact the editors responsible for this story: Sam Mamudi at smamudi@bloomberg.net, Josh Friedman, Dan Reichl

©2020 Bloomberg L.P.