Jul 27, 2019

Hedge Funds Bet Aussie Will Be Scuppered by Sluggish Inflation

, Bloomberg News

(Bloomberg) -- Australia’s dollar took a beating last week and worse may be to come in the form of quarterly inflation data due Wednesday.

The currency slid about 1.5% over the five days through Friday as influential Westpac Banking Corp. economist Bill Evans brought forward his forecast for the next interest-rate cut to October, and Reserve Bank of Australia Governor Philip Lowe said he was ready to ease again to revive economic growth.

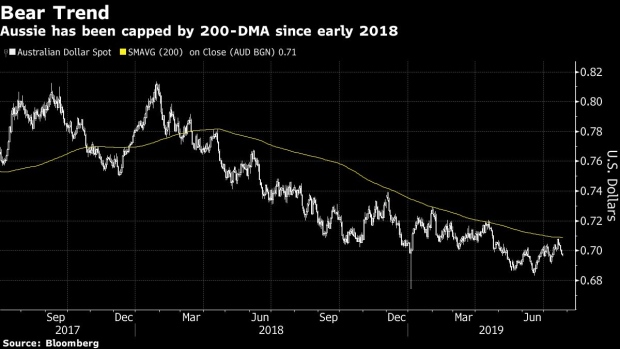

The one-two punch put an end to a one-month rally in the Aussie and ensured the currency remained in a long-term downtrend, capped by its 200-day moving average. Slow stochastics, an indicator of momentum, suggests more weakness lies ahead at least in the short term.

Leveraged funds are among those betting on further losses. They held a net short position of 16,868 contracts for the week ended July 16, close to the most bearish this year, according to Commodity Futures Trading Commission data.

Overnight interest-rate swaps are pricing in a 90% chance of a rate cut in October, up from 40% odds at the start of last week. That would be the third reduction this year following moves in June and July that have pushed down the benchmark to a record-low 1%.

The next leg down in the Aussie may be triggered by Wednesday’s inflation data. Economists predict the trimmed mean reading will fall to 1.5% for the second quarter, which would be the lowest since December 2016. The gauge has remained stubbornly below the central bank’s 2%-to-3% target range for more than three years.

Speaking on Thursday, Lowe flagged the importance of keeping borrowing costs low until inflation recovers. “On current projections, it will be some time before inflation is comfortably back within the target range,” he said at a speech in Sydney

A further batch of disappointing inflation data may see investors boost pricing on another rate cut even further, and bring a smile to the face of Aussie bears.

Below are key Asian economic data and events due this week:

- Monday, July 29: Japan retail sales

- Tuesday, July 30: Australia building approvals, New Zealand building permits, BOJ policy decision and outlook report, Japan industrial production and jobless rate, South Korea manufacturing and non-manufacturing business surveys

- Wednesday, July 31: Australia 2Q CPI, New Zealand ANZ business confidence, Japan consumer confidence and construction orders, South Korea industrial production, China manufacturing and non-manufacturing PMI, Thailand trade balance and BoP current account balance

- Thursday, Aug. 1: Japan Jibun Bank manufacturing PMI, BOJ’s Amamiya speaks, South Korea CPI, trade balance and manufacturing PMI, China Caixin manufacturing PMI, Indonesia CPI, Thailand CPI and business sentiment index

- Friday, Aug. 2: Australia retail sales, 2Q retail sales ex-inflation and PPI, New Zealand ANZ consumer confidence, BOJ minutes to June meeting, Malaysia trade balance

--With assistance from Stephen Spratt.

To contact the reporter on this story: David Finnerty in Singapore at dfinnerty4@bloomberg.net

To contact the editors responsible for this story: Tan Hwee Ann at hatan@bloomberg.net, Nicholas Reynolds

©2019 Bloomberg L.P.