Aug 19, 2019

Hedge Funds Boost Bets Against Euro on Prospect of ECB Stimulus

, Bloomberg News

(Bloomberg) -- Hedge funds are betting against the euro on the prospect of the European Central Bank amping up its easy monetary policy.

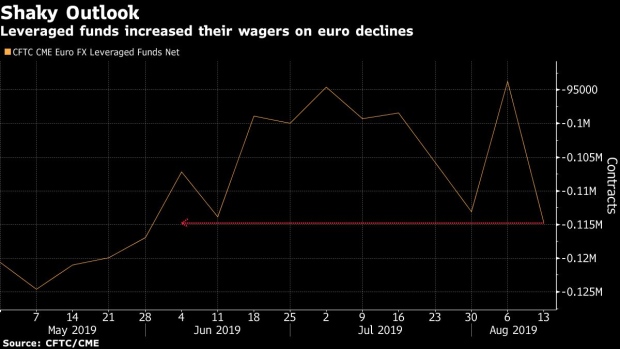

Speculators increased their wagers on the shared currency’s decline to the most in almost three months, according to positioning data up to Aug. 13 from the U.S. Commodity Futures Trading Commission. While the euro was supported Monday by the prospect of Germany increasing spending, it touched a two-year low against the dollar on Aug. 1.

The common currency is also facing political headwinds with Italy’s government looking close to unraveling, and the U.K. seemingly headed for a crash exit from the European Union in just over two months. Markets are bracing for ECB policy makers to loosen policy even further as soon as next month to prop up the region’s faltering economy.

“Despite the softer data, the easing regime-shift by the ECB is not yet fully reflected in positioning or valuations,” said strategists at JPMorgan, including Meera Chandan. “ECB dovishness and weak growth are still the main drivers of our bearish euro stance. Italian politics are an incremental negative in the near term.”

The euro traded up 0.1% at $1.1103 at 12:10 p.m. in London, after falling 1% last week. JPMorgan strategists now see the euro slipping to $1.10 by September and trading at that level into the end of the year, lower than their earlier end-2019 call of $1.13. One-month volatility in the shared currency against the dollar has touched a six-month high amid uncertainty over how policy makers will respond to a deepening global downturn.

To contact the reporter on this story: Anooja Debnath in London at adebnath@bloomberg.net

To contact the editors responsible for this story: Ven Ram at vram1@bloomberg.net, Neil Chatterjee

©2019 Bloomberg L.P.