Mar 15, 2021

Hedge Funds Kicked Off 2021 With $49 Billion Sale of Treasuries

, Bloomberg News

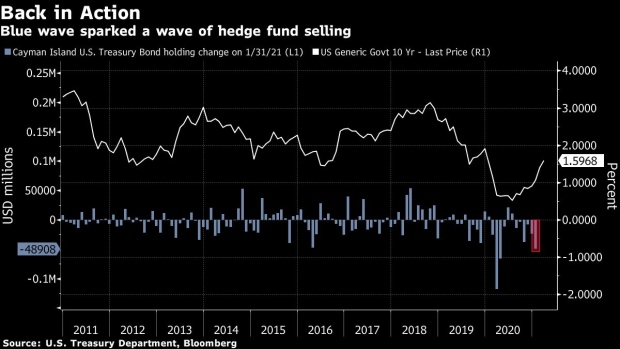

(Bloomberg) -- Hedge funds offloaded the most Treasuries in nine months in January, foreshadowing a selloff in U.S. bonds that occurred just weeks later.

The Cayman Islands, seen as a proxy for hedge funds and other leveraged accounts, dumped $49 billion of U.S. sovereign bonds, making it the largest net seller of the debt that month, according to the latest data from the Treasury Department.

The selling came on the back of the Democratic victories in the January 5 Georgia run-off race which paved the way for bumper stimulus spending to revive the U.S. economy. Bets for growth and inflation to quicken have since gained traction, fueling a jump in Treasury yields to the highest in over a year.

Benchmark U.S. yields rose 15 basis points in January to break the 1% level for the first time in over nine months. The data, released on Monday, suggest hedge funds were well positioned for what was to follow, as yields surged another 34 basis points in February.

Hedge Fund Research Inc.’s Macro Total Index, which tracks discretionary macro managers among others, climbed 0.2% in January, before clocking up a 2.8% gain in February.

©2021 Bloomberg L.P.