Aug 22, 2022

Hedge funds pile into a record hawkish rate bet pre-Jackson Hole

, Bloomberg News

Powell does not want to be the central banker who let inflation get out of control: John Silvia

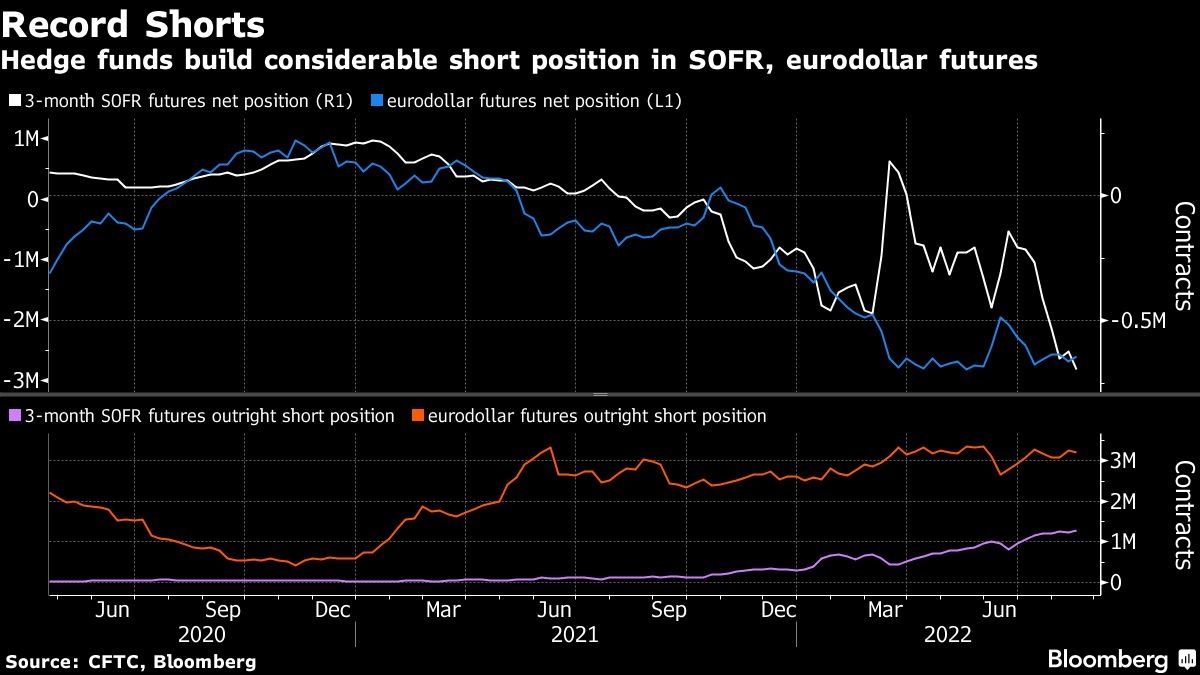

Hedge funds are unleashing record bets that the Federal Reserve will stick to its hawkish script as they rapidly position for higher interest rates in a key corner of the derivatives market.

The group has collectively placed a big short across futures referencing the official successor to London interbank offered rate known as the Secured Overnight Financing Rate. This wager stands to benefit should Fed Chair Jerome Powell effectively rule out a dovish pivot at this week’s annual symposium in Jackson Hole.

The net-short positioning hit an unprecedented 695,493 contracts in the latest Commodity Futures Trading Commission data. That’s the equivalent of around US$17 million of cash risk on the table per-basis-point move.

The pace at which hedge funds have built up this short position has more than tripled in size over the past month -- even as the broader futures market continues to price in interest-rate cuts by the end of the next year.

Meanwhile in eurodollar futures, short wagers from hedge funds are near this year’s highest levels at just over 2.6 million contracts, on a net basis.

Yields in the policy-sensitive two and three-year Treasury both climbed more than 10 basis points, before pulling back slightly in thin trading on Monday, with the prospect of a two-year sale on Tuesday and a hawkish Fed overshadowing market sentiment.

The three-year note was up 10 basis points at 3.36 per cent, its highest level since June 21, late in New York trading. The two-year rate was up 8 basis points at 3.31 per cent, after rising nearly 11 basis points to 3.34 per cent earlier in the session. The 10-year yield climbed to trade above 3 per cent for the first time in a month.

“It’s not a surprise to see higher front end yields but it is a surprise to see the magnitude of the rise,” said Ian Lyngen, head of US rate strategy at BMO Capital Markets. The fact that the three-year was leading the selloff, “makes this more of a Fed play than supply,” and the bearish positioning in Treasuries reflected the prospect “the Fed does not indicate a policy shift anytime soon.”

It’s not just the front-end of the curve where traders are positioning for a hawkish outcome into the Jackson Hole meeting. Over the past two sessions, they’ve built up large put structures in 10-year notes -- targeting a move higher in 10-year yields to as high as 3.70 per cent within a month. The buying continued in Monday’s session, although shifting from October options out to November maturities.

The fate of these wagers lies in the immediate path of policy rates. The swaps market is roughly pricing in a 50/50 chance that the Federal Reserve will hike by 50 or 75 basis points at its Sept. 21 decision, leaving the Jackson Hole gathering as a key event to shore up conviction one way or another.

“Market opinion initially was split last week about whether the FOMC minutes were hawkish or dovish,” said Lou Crandall, economist at Wrightson ICAP Llc. “There won’t be any such ambiguity about Chair Powell’s Jackson Hole speech on Friday.”

An inversion of around 30 basis points in the December 2022/December 2023 SOFR futures spread shows expectations that the central bank will be cutting rates by the end of next year.

Wagers on this type of dovish-pivot scenario have diminished somewhat over the past week, however, with the inversion of the one-year curve easing from as much as 75 basis points over a month ago to below 30 basis points currently.