Jun 29, 2020

Hedge Funds Score Big Gains on Dividend Trades That Burned Banks

, Bloomberg News

(Bloomberg) -- One of the largest financial market dislocations of the Covid-19 era has generated big gains for hedge funds that bet the turmoil would prove short-lived.

The winning trades involved dividend futures, which derive their value from shareholder payouts by companies in benchmark stock indexes. Historically among the most stable of equity-linked investments, the securities have swung even more wildly than share prices over the past three months.

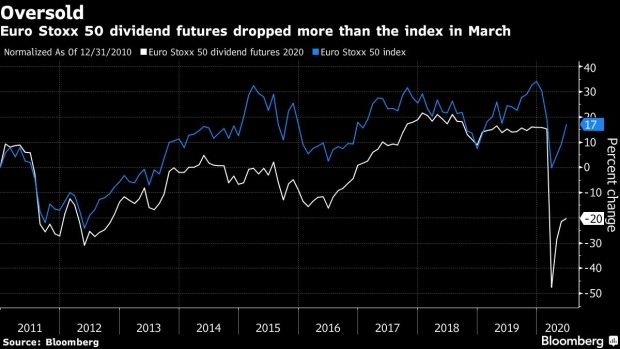

One of the most heavily traded contracts in Europe tumbled almost 60% in March as a spate of dividend cuts spooked investors and banks dumped futures to hedge exposures at their structured product units. While firms including BNP Paribas SA, Societe Generale SA and Natixis SA lost money on their positions in the first quarter, the sell-off created buying opportunities for a clutch of bargain hunters.

Ovata Capital Management, Oasis Management Co., York Capital Management and AM Squared Ltd. all scored double-digit returns on dividend futures as the securities snapped back from the March rout, buoyed by unprecedented government stimulus. The bets have helped the funds post year-to-date gains, bucking a 5% slump through May for the Bloomberg All Hedge Fund Index.

“The pace of the meltdown was even faster than in 2008 and it went too far,” said Rodrigo Rodriguez, a Jersey-based partner at Ovata who previously held senior trading roles at JPMorgan Chase & Co. and Credit Suisse Group AG. Ovata, which manages $750 million, has returned an estimated 4.6% this year through June 25.

Dividend futures are usually less volatile than stock indexes, in part because shareholder distributions tend to be more stable and predictable than equity valuations. But in March it was dividend bets that suffered deeper losses as the pandemic sent shockwaves through global markets. Investors offloaded futures as companies from Occidental Petroleum Corp. to Deutsche Lufthansa AG cut or suspended their payouts and big banks faced pressure to follow suit.

Euro Stoxx 50 dividend futures expiring in December sank as much as 57% in a span of four weeks, after moving less than 2% during most months last year. By contrast, the Euro Stoxx 50 index recorded a peak-to-trough slide of 38%.

The disconnect was partly fueled by selling pressure from banks that had issued high-yield structured products and were using dividend futures to hedge their obligations. As futures prices fell, the banks had to offload an ever-greater number of contracts into a market bereft of buyers.

At least one large hedge fund manager was also caught in the downdraft. London-based LMR Partners told investors that the collapse in European dividend futures contributed to a 24% March decline in one of its funds, which also took a hit from volatility trades gone awry, according to a person with knowledge of the matter.

While the plunge in dividend futures was deep, it didn’t last long. Prices began rebounding in early April on optimism that historic economic support measures from the Federal Reserve, European Central Bank and others would give some companies scope to continue their payouts.

Read more: Green Shoots Emerge in World Economy as Virus Lockdowns Ease

Ovata positioned for the rally by purchasing dividend futures linked to the Euro Stoxx 50, FTSE 100 and S&P 500, hedging its bets with bearish positions on those same indexes, Rodriguez said. The fund also bought Nikkei 225 dividend futures expiring in 2021 and sold 2020 contracts as a relative value trade.At Oasis, led by Highbridge Capital Management alumnus Seth Fischer, dividend futures were among the top contributors to returns in April, May and June, according to fund documents seen by Bloomberg News.

The fund placed bearish wagers on 2020 and 2021 Euro Stoxx dividend futures in the early weeks of Covid-19, while going long contracts maturing in 2025 and beyond. In late March, it covered the shorts and switched to buying across maturities. Euro Stoxx dividend futures expiring in December have jumped more than 60% from an April 3 low.

Oasis, which posted an overall gain of 7.6% this year through June 16, also placed bullish wagers on 2020 and 2021 Nikkei dividend futures in late March, after prices had dropped about 35%. The fund was encouraged by data showing that 81% of Nikkei firms pay stable dividends. Companies in the gauge held 349 trillion yen ($3.3 trillion) in cash as of their latest filings, a 54% jump from five years ago, data compiled by Bloomberg show.

Convinced that Japanese dividends were sustainable and likely to continue amid ongoing corporate governance improvements, York Capital also took advantage of the sell-off in 2021 Nikkei dividend futures, notching a 30% gain before taking profit, said a person with knowledge of the matter. The firm’s $2.5 billion Asia fund is up an estimated 10% this year, the person said. York Capital, which is based in New York, and Oasis, based in Hong Kong, declined to comment.

AM Squared, which oversees about $250 million, bought 2022 Nikkei dividend futures, taking profit on the trade after making double-digit returns, said Arjun Menon, the fund’s chief investment officer in Hong Kong. The contracts have rebounded 33% from this year’s low.

The recovery has also eased the pain for some investors who got hit by the March selloff. LMR, for example, has recouped the March losses in its dividend arbitrage strategy, a person with knowledge of the matter said. The fund declined to comment.

©2020 Bloomberg L.P.