Nov 14, 2019

Hedge Funds Shop for Netflix, Facebook in Volatile Third Quarter

, Bloomberg News

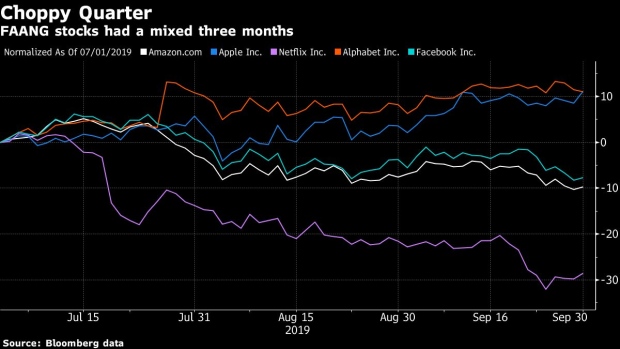

(Bloomberg) -- U.S. hedge funds bought shares of Facebook Inc. and Netflix Inc. despite steep declines in the technology darlings during a volatile third quarter.

Chase Coleman and David Tepper were among the money managers who increased their Facebook holdings during the three-month stretch that saw the social-media giant fall nearly 8%. Netflix was favored by firms including Lee Ainslie’s Maverick Capital Ltd. and Dan Sundheim’s D1 Capital Partners despite a 27% drop in the three months ending Sept. 30.

Hedge fund managers, who have long adored FAANG stocks, had to navigate a tumultuous period. While Amazon.com Inc. also fell, down 8%, Google parent Alphabet Inc. and Apple Inc. both rose more than 13%. At the same time, the S&P 500 index gained 1.2% amid an escalation in the U.S.-China trade war and dovish moves by central bankers.

Here are some other notable moves:

- Harvard University’s endowment added 2 million Facebook shares, bringing the value of its position to roughly $400 million on Sept. 30, and making the company its biggest single U.S. equity holding.

- Stan Druckenmiller offloaded almost his entire stake in Uber Technologies Inc., selling 2.5 million shares. His Duquesne Family Office took a stake in Shopify Inc.

- Warren Buffett’s Berkshire Hathaway Inc. announced new common-equity stakes in Occidental Petroleum Corp., which is on top of a preferred stake that was previously disclosed, and home furnishings company RH. The firm trimmed some of its largest stock bets, including Apple, Wells Fargo & Co. and Phillips 66.

- Viking Global Investors ditched its $1.2 billion stake in UnitedHealth Group Inc. as health-care stocks were hit by politics both in Washington and on the campaign trial.

- Maverick sold 690,000 shares of managed-care company Humana Inc., which had been the fund’s top U.S. equity position in the second quarter. (It now sits at No. 9).

- Microsoft Corp. was one of the less popular stocks for the second quarter in a row. Tiger cubs Viking, Coatue Management and Maverick all decreased their holdings in the tech giant as did Duquesne. But the software giant was up more than 3% during that period and has been a top performer this year -- shares have gained almost 46%.

--With assistance from Katherine Chiglinsky, Emma Vickers, Vincent Bielski, Scott Deveau and Michael McDonald.

To contact the reporters on this story: Katia Porzecanski in New York at kporzecansk1@bloomberg.net;Hema Parmar in New York at hparmar6@bloomberg.net;Melissa Karsh in New York at mkarsh@bloomberg.net

To contact the editors responsible for this story: Sam Mamudi at smamudi@bloomberg.net, Alan Mirabella

©2019 Bloomberg L.P.