Mar 26, 2023

Hedge Funds Wrong Footed by Bearish Yen Bets as Havens Rebound

, Bloomberg News

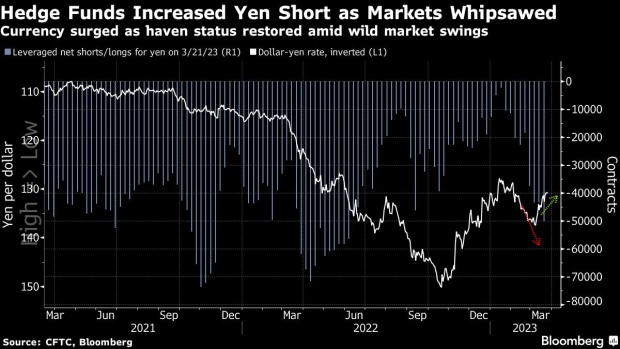

(Bloomberg) -- Hedge funds boosted their bearish bets on the yen to a nine-month high last week, just as the traditional haven regained buyers amid the global banking crisis.

Leveraged funds increased net-short positions to the most since June in the week to March 21, according to the latest data from the Commodity Futures Trading Commission. That’s likely to have been a painful trade — the Japanese currency extended its March gain to 4% last week after a government-brokered deal to rescue Credit Suisse failed to assuage concerns that stress in the banking system wouldn’t spread.

Fast-money funds may have been betting that a more-hawkish-than-expected Federal Reserve would boost the dollar and weigh on the yen. But a slump in global yields has taken pressure off the Japanese currency and it has benefited from the surge in demand for haven assets amid the banking fallout.

“We were pushing back on the growing consensus for yen strength, as our view of solid economic fundamentals — specifically our call for US growth resilience and a somewhat more hawkish Fed — still argued for renewed weakness,” wrote Goldman Sachs Group Inc. strategists including Kamakshya Trivedi on Friday. “Now, we see reason to expect the reverse in the very short term.”

The currency swung between gains and losses in early Asia trading as markets remain jittery over the prospect of a US recession. Morgan Stanley expects the yen to trade toward 120 per dollar, benefiting from a so-called “soft-landing” where the US doesn’t derail global growth, or a flight to haven assets should global growth deteriorate.

“Unfortunately it will take at least a few weeks to see whether the ‘Ides of March’ volatility has structurally impacted the data path,” strategists led by Matthew Hornbach wrote in a note to clients, referring to US economic data. “Until then, a neutral FX stance with a short USD/JPY hedge seems the most appropriate position while we wait for clarity.”

--With assistance from Ruth Carson.

(Updates with Morgan Stanley comment in last two paragraphs.)

©2023 Bloomberg L.P.