Feb 27, 2020

Here’s Where Investors Have Found Refuge in the Market Storm

, Bloomberg News

(Bloomberg) -- Even with the relentless coronavirus pushing the global economy toward its worst performance in over a decade, a number of investment themes are proving their resilience to the slump in sentiment.

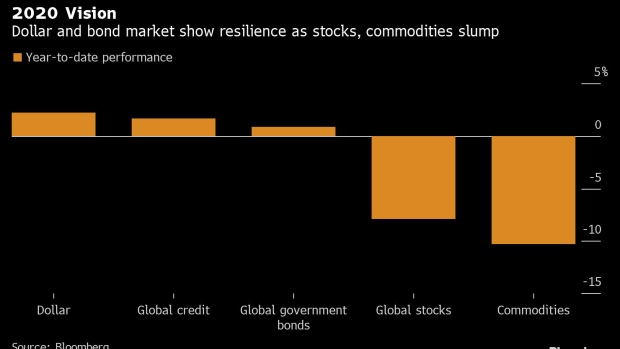

Looking at a multitude of asset classes around the world shows that credit and government bond funds are holding onto year-to-date gains, while stocks and commodities get pummeled. Meantime, the greenback is earning its safe haven stripes with the Bloomberg Dollar Spot Index up over 2%.

Here are five charts showing which assets are holding up best amid the turbulence:

Stocks

Just 11 of the 94 primary equity indexes tracked by Bloomberg are still in the green this year, and no global sectors are in positive territory. But one country still keeping its head above water is Denmark, where the benchmark OMX Copenhagen 20 Index remains about 2% higher year-to-date thanks in part to a heavy weighting in health care names.

Meanwhile, among some of the smaller indexes, China’s tech-heavy ChiNext stands out as it holds on to a near 18% gain this year.

Bonds

Haven assets have seen a huge increase in demand as investors ran to the safety of sovereign debt. The yield on 10-year U.S. Treasuries -- the global bond benchmark -- plummeted to a record low this week. Meanwhile, the stock of negative-yielding debt in the world has jumped almost $3 trillion this year to $14.2 trillion on Thursday.

Volatility

With equity volatility surging to levels not seen in more than a year as investors try to gauge the impact of the coronavirus’s spread, assets exposed to the move are enjoying their day in the sun. One example, the ProShares Ultra VIX Short-Term Futures has surged almost 70% year-to-date.

Gold

The traditional safe haven in any risk-asset sell-off is gold and this time is no different. It’s climbed about 8% this year and is trading near its highest in seven years.

Themes

Thematic investing is enjoying a surge in popularity and the resilience of a number of exchange-traded-funds in the space point to the reason why. Although the iShares Global Clean Energy ETF has fallen too this week, it is still sitting on a 7% gain in 2020. Meanwhile, the ARK Innovation ETF -- which invests in stocks linked to the theme of disruptive innovation -- is up 3% this year.

Even in Asia, the heart of the coronavirus outbreak, investing in particular themes is showing its worth. A Bloomberg basket of Asian “stay-at-home” stocks -- video game, internet-services and online health-care companies -- has crushed the broader market with a 2% gain year-to-date.

--With assistance from Joanna Ossinger.

To contact the reporter on this story: Cormac Mullen in Tokyo at cmullen9@bloomberg.net

To contact the editors responsible for this story: Christopher Anstey at canstey@bloomberg.net, Adam Haigh, Joanna Ossinger

©2020 Bloomberg L.P.