Sep 27, 2022

Hero Financials: A fresh and innovative financial solution that empowers youth

- In a complex world where children will eventually have to manage their own finances, financial literacy is an essential life skill

- Hero Innovation Group is filling in the gap by delivering innovative financial solutions to address specific unmet needs tailored to youth demographics

- The company recently launched their flagship product, Hero Financials, into the Canadian market and has been met with great acceptance

In school, we are taught subjects such as history, P.E., art, science and math, but when do kids have the opportunity to learn about money? About how to save and spend it wisely? These are skills we’ve all had to learn sooner or later, so why hasn’t there been focus on making it sooner, rather than later? Financial literacy among youth is a massively underserved area of education. In this digital age, kids are growing up in an increasingly complex world, and taking control of their financial future is not a matter of “if,” but when.

Most of us follow the same traditional ways of banking that our parents used, with limitations like slow transfers, restricted cards and high overspending fees. Student accounts from larger banking institutions all offer the same thing, just repackaged. Kids still don’t have access to their money or have any transparency into how budgeting works.

According to a recent survey, only 15 per cent of parents said they spoke with their children frequently about money. This low percentage can drive the next generation of consumers into weaker or later financial independence. Through financial literacy, it’s fundamental we lead this generation of youth into a future where they feel equipped with the knowledge and ability to budget and prioritize.

"The prepaid credit card facility with category control is our SideKick Card and the platform is Hero. So, every Hero needs a SideKick. With that in mind, we can have multiple heroes to multiple sidekicks. Whether that's blended families, grandparents — here or offshore." – Peter MacKay, CEO, Hero Innovation Group Inc.

Financial literacy that stays relevant with youth

Not only does financial literacy have some catching up to do, but it also needs to adapt and evolve with this generation. Hero Innovation Group Inc. (CSE: HRO) is at the forefront of this new wave, delivering innovative financial solutions for the next generation of consumers. Parents are demanding safety, security, and peace of mind — and this company is excelling on all fronts, while promoting relevant financial literacy for the future.

Kids get money, they spend the money, then ask for more money. Hero helps level up this relationship around money by creating a symbiosis between parent and child. Young adults crave an independence that requires time, practice, and trust from their guardians. It’s unfair that many from previous generations never had access to relevant resources to sooner grow into that financial power.

"Financial literacy is an underserved area of education and it isn't being addressed at the forefront by financial products that are out there. We’re falling into the products and services that our parents used and falling into the habitual way of using financial services that gets passed on," explains Peter MacKay, Hero Group’s CEO.

For Hero Group, financial literacy is their infinite game. This is largely reflected in the company’s efforts to continually diversify its products and address specific unmet needs of North American youth.

Gen Z-oriented fintech banking

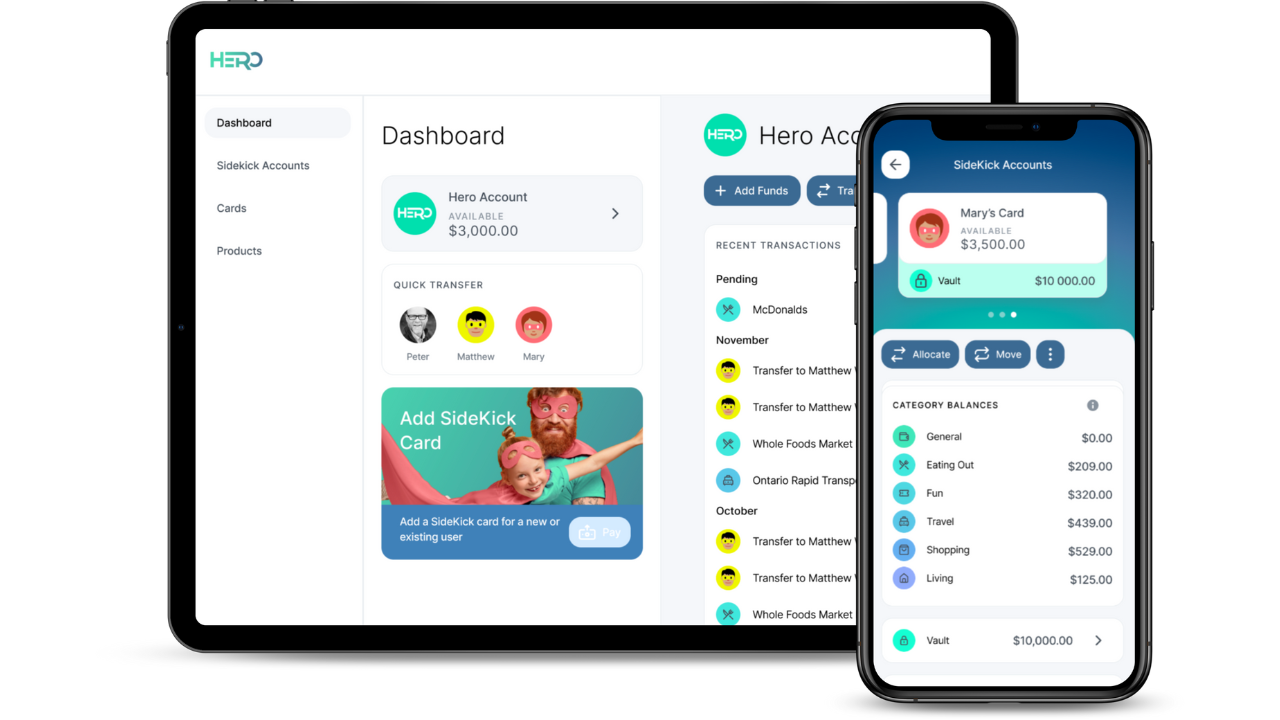

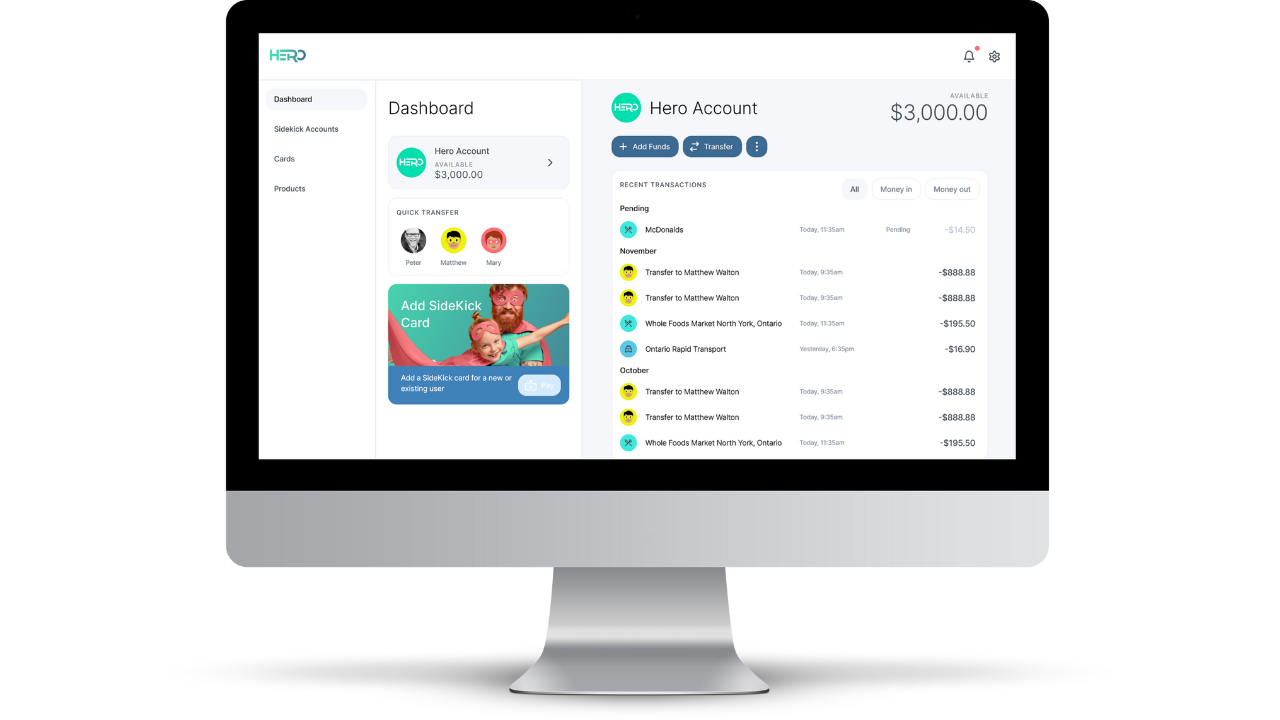

Swooping in to the rescue is Hero Financials, Hero Innovation Group’s alternative-to-banking solution. This full-service alternative allows guardians to easily provide funds to their dependents while controlling and monitoring payments. With the Hero platform, parents can work with their kids on where to spend (or not to spend) that money.

Along with their popular Hero Financials service, is Hero Group’s SideKick prepaid Mastercard. The two services pair together to fully equip kids with vital financial literacy skills. It offers a unique element of control where both parents and child are empowered to build trust between one another. Parents can receive alerts where their kids are spending, and work together on creating categories for their allowance — such as savings, spendings, eating out, shopping , etc.

How does the Hero Platform work?

As you may have personally encountered, there are many limitations and restrictions imposed by traditional consumer banks. With Hero, money transfers are sent in real-time, and these funds can be used by kids in-store and online, via contactless and chip payments wherever a prepaid Mastercard is accepted.

"The prepaid credit card facility with category control is our SideKick Card and the platform is Hero. So, every Hero needs a SideKick. With that in mind, we can have multiple heroes to multiple sidekicks. Whether that's blended families, grandparents — here or offshore," explains MacKay.

Other resources of Hero include security features, recurring allowance, and a block list. For blended families, and even grandparents or any family offshore, a sidekick can have multiple heroes taking care of them. This service will also soon support digital payments through a wallet function, whereby users can make payments from their Hero accounts via third-party mobile payment apps such as Google Pay, Apple Pay and Samsung Pay.

Users will also soon be able to take advantage of its latest Round-Up feature, whereby purchases are rounded up to the nearest dollar and the spare change is automatically deposited into a savings account, called Vault, for any user’s short-term or long-term goals.

“With category controls, child-parent relationships, the vault (roundup facility), and goal setting, these are some of the features that are key to what we do” says MacKay.

Putting money into a kids' account is not enough; it's about getting kids into the habit of saving. 70 per cent of millennials have a saving mentality, now the goal is to pass this onto Gen Z in a way that grows with their lifestyles.

The SideKick Card is an award-winning financial solution for international students in Canada and now in high demand for the Canadian demographic of youth.

With instant transfers and allocated spending categories, kids are enabled to make smart purchases using their Hero SideKick Mastercard, which is already accepted at most Canadian in-store and online retailers.

The growth trajectory for Hero is flying high. So, what’s next for the team?

With impressive feedback from user groups, the international SideKick Card was met with immediate acceptance (and excitement) worldwide. Moving from the international student market coming into Canada over the pandemic quickly led the team to realize Canadian youth were massively underserved as well.

After quietly working behind the scenes for months, the recent launch of Hero Financials for the Canadian Market has been met with great acceptance not only from parents, but professionals and the student community.

The company has jumped from a 600,000 potential market up to a 6 million market by expanding into the domestic youth demographic in Canada. The market has been long overdue for products like this. Canada will also see a wealth management facility soon that fits right into planning for the future, as part of financial education.

Hero Group is crushing one milestone after another. After lots of research and focus groups, their offer of wealth management solutions for users are expected in Q4 of 2022. There are plans for future expansions into the U.S. for early 2023 with incredible banking partners, and North American parents are energized and readier than ever to uplift their sidekicks. Thousands have signed up already.

Sidekicks are fast learners — they just need the opportunity

How do we ensure the next generation has the proper tools to achieve financial literacy as they get older? The benefits for youth with financial expertise are rich — higher rates of having a chequing account, budgeting more often, and lower rates of mortgage defaults in the future. Educated actions that their adult selves would be grateful for.

Hero Group is providing a solution to this by offering the support this next generation of consumers need with a laser focus on financial literacy. The company is trailblazing and finding solutions to empower kids and teens with financial independence in new hands-on ways that align and evolve with our ever-changing digital lives. Their products offer what is trending, valued, and relevant to these demographics: access to a Mastercard, budgeting solutions, wealth management (investments), and an all-in–one app solution for easy access.

Hero Group’s goal is to provide this generation of youth with a controlled platform for their daily digital transactions, budgeting, and planning for the future. Afterall, these sidekicks will become financially smart heroes one day.

With the company’s rapid introduction of new products and features, paired with their plans to expand across North America, Hero Group is poised for significant growth to become a household name. The community response continues to be overwhelmingly positive.

For more information on Hero Innovation Group, visit their website here.

Make sure to follow Hero Innovation Group Inc. on social media for the latest updates: