May 20, 2022

High Eurobond Yields Steer Ivory Coast to Regional Debt Market

, Bloomberg News

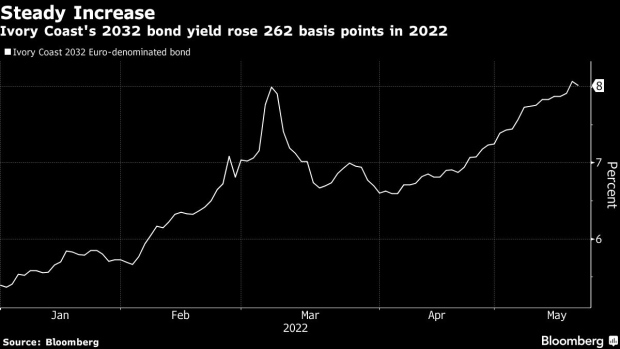

(Bloomberg) -- Ivory Coast is turning to its regional debt market after postponing a planned Eurobond offering over the high cost of borrowing on international debt markets.

The West African economy is targeting interest rates of no more than 6%, Finance Minister Adama Coulibaly said in an interview Friday in Paris. The world’s top cocoa producer raised the euro equivalent of $1.7 billion in 12-year debt at 4.875% in November 2020.

“We cannot let ourselves borrow, like other countries did, at 8% or 9%,” Coulibaly said. “Ivory Coast has a good history on financial markets. We’ve had very interesting rates.”

Ivory Coast is rated BB- by S&P Global Inc., three levels below investment grade. Borrowing has become prohibitively expensive for junk-rated issuers from emerging markets. Nigeria borrowed at a coupon of 8.375% for a $1.25 billion offering in March, which was about two percentage points more expensive than similar debt issued six months earlier. Kenya said it may scrap a plan to sell $1 billion of Eurobonds by the end of June because of the jump in yields.

“As an alternative, we are tapping the regional market,” he said. “It remains to be seen if this market is deep enough to satisfy the eight countries of this area, but for now, things are going well.”

Ivory Coast raised 41 billion CFA francs ($66.1 million) of five-year debt at 5.2% on May 17 and 28.2 billion CFA francs of the same duration and rate last month on the eight-nation West African Economic and Monetary Union Government Securities Market.

The country last year postponed a plan to sell as much as 1 billion euros ($1.06 billion) of debt, which would have been its third international debt sale in less than a year.

“It is an issuance that we had well prepared, with an ESG label” to attract stronger demand from investors, Coulibaly said. It still plans to sell green bonds, and might consider so-called blue bonds -- which raise money for environmentally friendly marine projects -- if and when markets normalize, he said.

CFA Franc Reform

The $70-billion economy faces fiscal pressure after taking measures to curb inflation linked to the Russian war on Ukraine. Capping the pump price of fuel and other essential goods, restricting exports to neighboring nations, and introducing a tax exemption on wheat are expected to cost the government 400 billion CFA francs, or 1% of gross domestic product, in lost revenue, said Coulibaly.

The CFA franc’s peg to the euro has helped ease inflationary pressures, with annual price increases seen at 4.5% by the end of this year, he said. “When you look at the level of inflation in West Africa, it is much lower than in other countries.”

Currency reform has been delayed by the inability of countries in the region to meet the West African Economic and Monetary Union’s convergence criterion of 3% fiscal-deficit target by 2024. Ivory Coast shares the CFA franc currency with seven of its neighbors.

“With Covid, the war in Ukraine and so forth, the convergence criteria have been suspended,” he said. “At the regional level, the convergence deadline has been postponed to 2027.”

©2022 Bloomberg L.P.