Dec 8, 2021

Historic Decoupling From Treasuries Bodes Well for Munis in 2022

, Bloomberg News

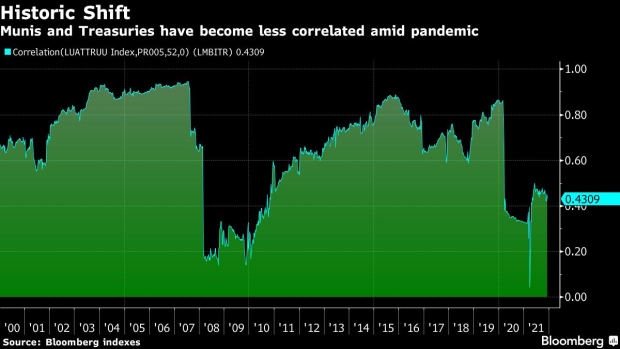

(Bloomberg) -- Municipal bonds’ correlation with Treasuries has broken down since the onset of the pandemic, a phenomenon that’s expected to benefit the $4 trillion state and local debt market in 2022 as Wall Street braces for higher yields.

The historic link between the two asset classes crumbled when the coronavirus outbreak roiled markets early last year. Municipal debt sold off at the time as investors yanked cash out, while Treasuries surged amid a massive flight to safety.

The relationship has recovered since, but munis still aren’t following Treasuries the way they used to. The weekly correlation coefficient of the Bloomberg Municipal Bond index to the U.S. Treasury index is about 0.43, compared with around 0.9 before the pandemic struck, and an average of 0.67 since 2000. A reading of 1 means they’re moving in lockstep, while -1 would indicate a completely inverse correlation.

The diminished link has key implications for the year ahead. With the Federal Reserve removing policy accommodation and inflation still elevated, the bond market is bracing for higher Treasury yields. Munis, however, may hold up relatively well in comparison, positioning them as a possible hedge.

“Munis are likely to retain a greater amount of their value compared to other asset classes should there be a selloff in Treasuries” in 2022, said Wesly Pate, a portfolio manager at Income Research & Management.

The municipal market is already outperforming in 2021, in part as lawmaker debate lifting taxes on the wealthy. State and local debt has earned 1.4% this year while Treasuries have lost 2.2%, according to Bloomberg indexes.

In Pate’s view, the two markets have decoupled because munis’ buyer base has gotten “stickier,” meaning individual investors are reluctant to sell because of the “embedded gains” in their portfolios. If they sell, they’d have to pay capital-gains taxes and reinvest that money elsewhere -- even though other asset classes aren’t offering much incremental yield, he said.

He also says institutional buyers like banks and insurance companies have become less of a force in the municipal market after the 2017 tax overhaul cut the corporate tax rate. As a result of that shift, they aren’t moving in and out of the market as much, limiting volatility, Pate said.

“The combination of a stickier retail base coupled with large embedded gains is likely to keep turnover low and volatility much more muted compared to other asset classes,” he said.

©2021 Bloomberg L.P.