Aug 17, 2021

Home Depot slumps as sales hint at waning pandemic boom

, Bloomberg News

Jennifer Radman discusses Home Depot

Home Depot Inc. fell the most in almost six months after the retailer posted weaker-than-expected results in the second quarter, joining the trend of early pandemic winners coming back to earth after outsize gains over the past year.

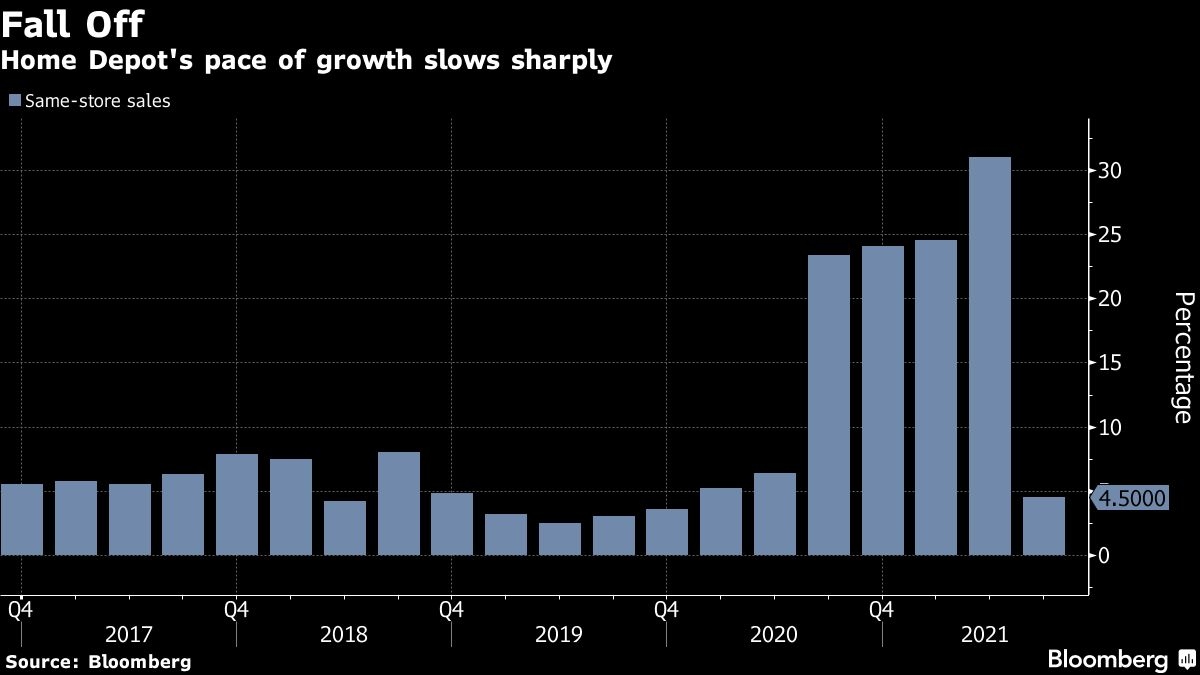

Same-store sales, a key metric in retail, rose 4.5 per cent in the period ended Aug. 1, the Atlanta-based company said Tuesday in a statement. That missed the 5.6 per cent average of analysts estimates.

The retailer’s historic revenue gains during the pandemic have been anchored by Americans fixing up their homes. Now, with the economy reopening, major renovations done by professionals are becoming a larger business. That led to an 11 per cent gain in the average purchase price, but overall transactions fell 5.8 per cent, not enough to sustain the momentum.

Home Depot may face increased competition from local businesses as consumer behavior shifts and the initial DIY craze subsides, said Neil Saunders, managing director of GlobalData. “It is so important for Home Depot to emphasize the convenience and speed of its online services,” Saunders wrote in a note. “It is going to have to work increasingly hard to secure that share from others.”

The shares fell 4.3 per cent at 9:50 a.m. in New York after an earlier drop of 4.9 per cent, the biggest intraday slide since Feb. 24. The stock headed for its eighth straight decline on the day of an earnings report.

The waning effects of the pandemic in the U.S. have reversed the fortunes of many companies that saw demand surge during lockdowns, from household cleaner Clorox Co. to streaming-video giant Netflix Inc. Walmart Inc. bucked the trend Tuesday, reporting same-store sales gains that topped analysts’ estimates.

While many competitors have released a forecast, Home Depot again declined to do so, citing continued uncertainty from the pandemic. One possible reason for the uncertainty at retailers like Home Depot and Walmart Inc.: Investors are struggling to figure out what will happen once government stimulus wanes, according to Edward Jones analyst Brian Yarbrough.

The company is also grappling with the impact of inflation, as commodity and shipping costs rise and some of the effects are being passed along to consumers.