US Existing-Home Sales Decline as Rates Keep Buyers Sidelined

Sales of previously-owned homes in the US fell in March from a one-year high, underscoring the lingering impact of high mortgage rates and elevated prices.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Sales of previously-owned homes in the US fell in March from a one-year high, underscoring the lingering impact of high mortgage rates and elevated prices.

Mortgage rates in the US climbed past 7% for the first time this year.

Mortgage shopping isn’t getting much easier these days.

Blackstone Inc. collected more fees from big retail funds and credit strategies during the first quarter, compensating for the slower pace of deal exits.

Ken Griffin’s Citadel and Citadel Securities will move their London base to a new office tower on the edge of the City of London, a major expansion of their space in the latest sign of the firm’s growing heft.

Feb 25, 2020

, Bloomberg News

(Bloomberg) --

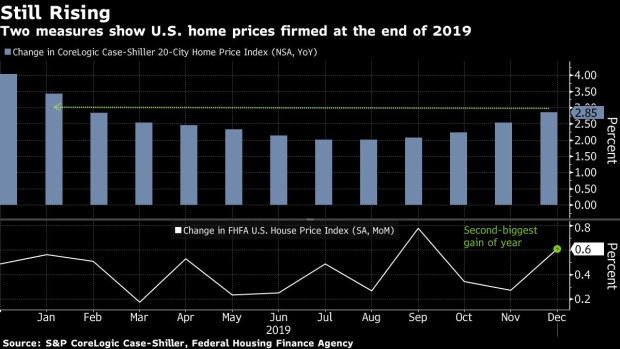

Home prices in 20 U.S. cities advanced in December by the most in nearly a year on the heels of stronger demand and lean inventory.

The S&P CoreLogic Case-Shiller index of property values increased 2.9% from the same month the previous year, data released Tuesday showed. That’s the biggest annual advance since January 2019 and matches the median forecast in a Bloomberg survey of economists. Prices were up 0.4% from November.

Key Insights

Get More

(Adds graphic)

To contact the reporter on this story: Katia Dmitrieva in Washington at edmitrieva1@bloomberg.net

To contact the editors responsible for this story: Scott Lanman at slanman@bloomberg.net, Vince Golle

©2020 Bloomberg L.P.