Asian Shares to Be Pressured, Chipmakers in Focus: Markets Wrap

Asian stocks were mixed at the open after US shares extended their losing streak to the longest since January.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Asian stocks were mixed at the open after US shares extended their losing streak to the longest since January.

President Joe Biden called China “xenophobic” while highlighting the Asian nation’s economic woes, as he sought to make the case for US economic strength during a campaign stop in the swing state of Pennsylvania.

Freddie Mac is seeking regulatory approval to expand into guaranteeing second mortgages, a shift that would potentially drive down costs for Americans seeking to borrow against the equity in their home.

The US economy has “expanded slightly” since late February and firms reported greater difficulty in passing on higher costs, the Federal Reserve said in its Beige Book survey of regional business contacts.

The City of London approved a plan to build a new office block connected to the Grade 2 listed Barbican Centre on Wednesday, despite opposition from residents.

Oct 19, 2020

, Bloomberg News

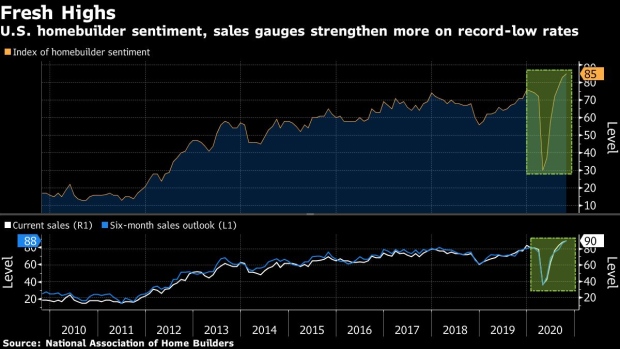

(Bloomberg) -- U.S. homebuilder confidence advanced in October to a fresh all-time high as record-low interest rates continued to fuel sales and the demand outlook.

A gauge of builder sentiment climbed to 85, the highest in records back to 1985, from 83 a month earlier, according to the National Association of Home Builders/Wells Fargo Market Index released Monday. The October reading was stronger than the median forecast of 83 in a Bloomberg survey of economists, and marked the sixth straight month builder sentiment has exceeded the consensus estimate.

The booming housing market has been a bright spot for the economy since the coronavirus lockdowns eased. Declining mortgage rates are making it easier for buyers interested in purchasing larger homes or relocating to suburbs as houses are increasingly viewed as remote workplaces in light of the pandemic.

“The concept of ‘home’ has taken on renewed importance for work, study and other purposes in the Covid era,” Chuck Fowke, chairman of NAHB, said in a statement. “However, it is becoming increasingly challenging to build affordable homes as shortages of lots, labor, lumber and other key building materials are lengthening construction times.”

Housing inventory remains lean and has kept home prices elevated. Also, shortages of some building materials and labor may restrain the hot housing market. The price of lumber, while down from its peak in mid-September, is still higher than any time last year. The stalemate in Congress over additional stimulus also risks slowing housing momentum.

The NAHB’s gauge of current single-family home sales rose by 2 points to a record 90 in October, while a measure of the outlook for purchases climbed 3 points to an all-time high of 88. The group’s index of prospective buyer traffic held at 74.

By region, builder sentiment in the West and Northeast rose to the highest levels on record, while confidence eased in the South and Midwest.

Homebuilders’ continuing optimism has driven an index of homebuilder stocks to a record high. The index has surged about 170% from this year’s low in March.

(Adds graphic)

©2020 Bloomberg L.P.