Mar 25, 2022

Homebuyers Hit With U.S. Mortgage Rates Surging Most Since 1994

, Bloomberg News

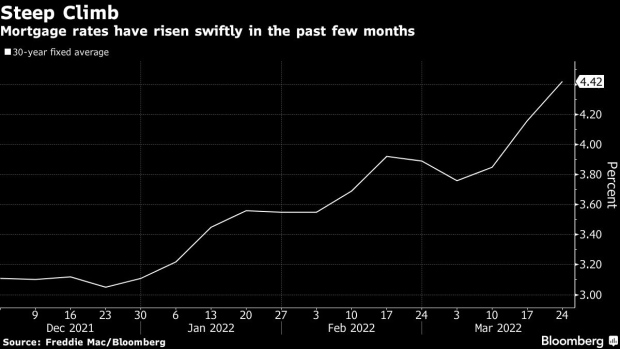

(Bloomberg) -- U.S. homebuyers already struggling to afford soaring prices must now contend with mortgage rates that are rising at the quickest pace in almost three decades.

The average for a 30-year loan climbed to 4.42% this week, the highest since January 2019, according to Freddie Mac. The speed of the increase has thrown borrowers and their brokers off-kilter: Since the end of December, rates shot up more than a percentage point, the biggest three-month jump since April 1994.

Americans are losing purchasing power fast as borrowing costs rise, inflation erodes savings and home price appreciation outpaces income growth. At the same time, cutthroat competition for scant inventory is pressuring buyers to make lightning-quick decisions. For those already stretching their budgets, swiftly rising rates are forcing them to recalibrate.

“This is likely going to cause many potential buyers to pause,” said Michael Fratantoni, chief economist of the Mortgage Bankers Association. “They had a budget in place and a price range they could afford when they started their shopping. This has thrown a curveball into their plans.”

David Goldberg, vice president of Mid-Island Mortgage Corp. on New York’s Long Island, said he’s losing trust with clients because he’s had to go back so many times to tell them that rates jumped.

One couple he works with, a schoolteacher and a mechanic, started looking for a home in Suffolk County in early February. They’ve lost a few bidding wars, and since starting their search, their estimated monthly payment climbed nearly $200. Even so, they were ready to make another offer, for a house priced at $500,000.

Last week, Goldberg had to tell them they were disqualified because their income was no longer high enough to cover their debt costs. The couple is one of many that have been sidelined, forced to continue renting.

“It’s a runaway train,” Goldberg said of the skyrocketing rates. “You give a quote to a client early in the day and hang up the phone with them. That offer may not be available anymore.”

The problem is compounded for people shopping in the tightest markets who are struggling to find anything they can afford. Relief from the fierce competition won’t come anytime soon: A panel of housing experts surveyed by Zillow said they expect listings nationwide to rebound to pre-pandemic norms, but not until 2024.

In Phoenix, deep-pocketed investors and a flood of affluent remote workers seeking sunshine and lower taxes are draining inventory and driving bidding wars -- a perfect storm for shoppers without large reserves of cash.

“It’s really horrible for first-time buyers,” said Jeremy Schachter, branch manager at Fairway Independent Mortgage Corp. in Phoenix. At the beginning of the year, Schachter quoted rates ranging from about 3.75% to 4.25% for conventional home loans. Now, he said, it’s up to 4.25% to 4.75%.

While none of his clients have been officially disqualified, some are teetering on the edge. Schachter doesn’t want to tell them it’s a lost cause, since there’s a chance rates will falter with so much volatility in global financial markets.

“It’s hard, because I don’t want to freak buyers out and say, ‘You need to find a house tomorrow,’” he said. “There are so many what ifs. You don’t want to scare people.”

One of Schachter’s clients in Phoenix, David Lafont, a 53-year-old interior designer, has lost three bidding wars since making his first offer in August. While not a first-time buyer, his cash is limited, putting him at a disadvantage against shoppers with big down payments.

What he’s able to afford is ultimately contingent on the interest rate at closing. But with such steep increases and homes going under contract within 72 hours after listing, he said, “it’s a difficult game to play.” While he still qualifies for a loan, payments are becoming increasingly unaffordable. At this point, Lafont said he might need to step back and wait it out.

“It just feels like we’re going to become a country of renters, with only a few select people owning property,” Lafont said. “Which is really discouraging, because that’s, of course, not the American dream.”

©2022 Bloomberg L.P.