Nov 30, 2022

Hong Kong Dollar Strengthens to Past Strong Half of Trading Band

, Bloomberg News

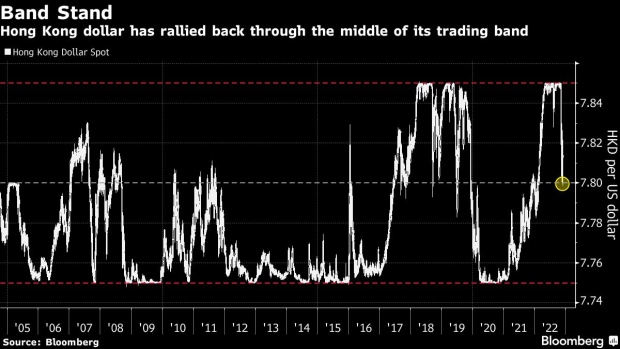

(Bloomberg) -- The rally in the Hong Kong dollar extended, with the currency strengthening to the strong half of it trading band as rising borrowing costs discouraged traders to short it.

The currency rose about 0.15% to 7.7986 per dollar Wednesday, passing the midpoint of its 7.75-7.85 trading band for the first time since February. The surge came as the Hong Kong Monetary Authority’s intervention in the foreign-exchange market effectively shrank interbank liquidity and lifted local rates.

The three-month Hong Kong interbank offered rate, or Hibor, rose to levels higher than the US equivalent for the first time since February last month, which means it’s no longer profitable for traders to borrow the Hong Kong dollar and sell it against the greenback.

HK Dollar Rises Toward Strong Half of Band as Short Sellers Bail

“Ahead of year end, it looks like seasonal Hong Kong dollar demand would keep local rates elevated” said Carie Li, global market strategist at DBS Bank Ltd in Hong Kong. She noted that Hong Kong dollar spot may trade below 7.85 per greenback in the coming month.

But the Hong Kong dollar may still retest the weak end of trading band “once the short covering settles and seasonal demand abates” along with with Fed’s further rate hikes, Li said.

©2022 Bloomberg L.P.