May 19, 2022

Hong Kong Dollar Traders Brace for Rate Spike Amid Intervention

, Bloomberg News

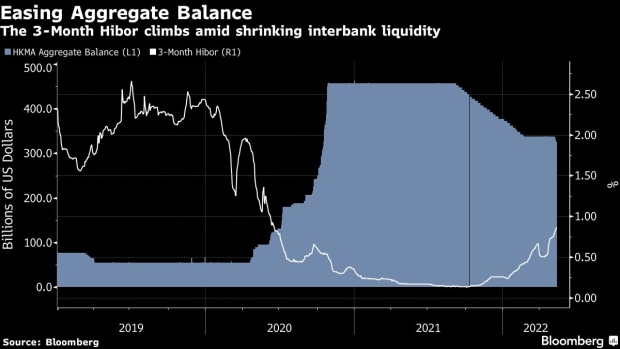

(Bloomberg) -- Hong Kong dollar traders are girding for tighter liquidity in the banking system as the city’s de facto central bank drains cash to maintain the currency’s peg to the greenback.

The city’s one-year interest rate swap -- a gauge of expectations for interbank liquidity in the future jumped to the highest since December 2018 last week. That’s following the Hong Kong Monetary Authority’s currency purchases after the local dollar breached the weak end of its 7.75-7.85 per greenback trading band for the first time since 2019.

“The climb in IRS reflects the view that Hong Kong dollar liquidity will tighten on the intervention,” said Eddie Cheung, senior emerging markets strategist at Credit Agricole. “Hong Kong dollar swaps have climbed pretty fast though they are erasing much of their premium from US rates,” he added.

While the swap rate hovers near its recent high, it may have room to rise further as the HKMA is expected to drain at least HK$125 billion to stem the Hong Kong dollar’s weakness. The HKMA has mopped up a total of HK$18 billion of the local dollar since last week, but the currency continues to hover around 7.85 against the greenback.

Moreover, the gap between the three-month Hong Kong interbank offered rate, or Hibor, and Libor of the same tenor remains near the widest since 2019. A wide gap allows traders to borrow the currency more cheaply in the interbank market and sell it versus the higher-yielding greenback, exacerbating outflows.

The reaction in Hong Kong rates so far doesn’t appear big enough to alleviate the downward pressure on the currency, as interbank liquidity remains ample, said Frances Cheung, rates strategist at Oversea-Chinese Banking Corp. in Singapore. “More FX intervention is likely to come,” she said.

©2022 Bloomberg L.P.