May 12, 2022

Hong Kong GDP Likely to Shrink Through June Despite Eased Curbs

, Bloomberg News

(Bloomberg) -- Hong Kong’s economy will likely shrink through the first half of the year as pandemic restrictions and rising global interest rates weigh on a city that has already warned such pressures will force it to revisit its official annual growth forecast.

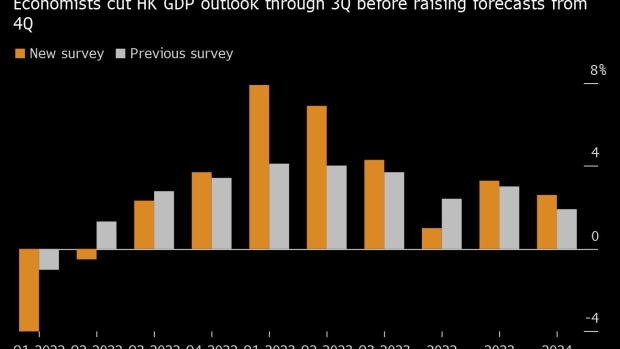

Economists now expect Hong Kong’s gross domestic product to contract 0.4% in the second quarter from a year prior, according to the median estimate in a new Bloomberg survey. That’s a cut of nearly two percentage points compared with a previous survey. The economy shrank 4% in the first quarter.

GDP growth forecasts for the third quarter were lowered to 2.3% while estimates for the fourth quarter rose to 4.1% as the city benefits from eased virus curbs. For the whole year, the economy is now seen growing 1%, less than half the 2.4% prediction of the previous survey.

The annual headline inflation outlook was raised by 20 basis points to 2.3%, while the unemployment rate is expected to edge higher to 4.3% in 2022.

The mostly downward GDP revisions for 2022 come after Hong Kong registered a sharper-than-expected contraction in the January-to-March period. Final estimates are due Friday, and are unlikely to change.

Financial Secretary Paul Chan warned Sunday that pressures from the pandemic and the US Federal Reserve’s interest rate hikes will inevitably push Hong Kong to cut its economic growth forecast for the year. The government’s current projection, announced in February, has GDP expanding between 2% and 3.5% in 2022.

That was as the city began reporting record numbers of Covid infections and deaths as a result of an omicron outbreak. Authorities imposed restrictions that severely curtailed economic activity, and Hong Kong’s trade was hampered by outbreaks and lockdowns in China.

“The growth outlook remains challenging, given the spillover effects of the Covid lockdowns in mainland China on trade and investment, at a time when US Fed policy tightening increases capital outflow pressures,” said Lloyd Chan, economist at Oxford Economics, who expects Hong Kong’s economy will barely grow for the year.

The financial hub is recovering. Daily cases have fallen dramatically and the government has begun rolling back the restrictions that crushed consumer spending and caused retail sales to plunge.

Even so, Hong Kong faces a lot of challenges as it remains largely isolated from the world with quarantines still in place for travelers.

The city is also bracing for higher interest rates, as its monetary policy is imported from the US because the local currency’s exchange rate is pegged to the dollar. Selling of the Hong Kong dollar has intensified in recent months and pushed it to the weak end of its trading band, prompting the city’s monetary authority this week to buy the local currency for the first time since 2019.

Even with that intervention, the Hong Kong Monetary Authority has a “significant war chest,” said Heron Lim, an economist at Moody’s Analytics. He added that the peg is “defensible,” and expects the impact of the currency on the real economy to be “limited.”

©2022 Bloomberg L.P.