Jun 2, 2020

Hong Kong Hedge Fund Offers 100% Coverage on Losses. For a Fee

, Bloomberg News

(Bloomberg) -- A Hong Kong hedge fund is offering to cover 100% of any losses in a bid to attract investors that have been avoiding the sector amid the Covid-19 pandemic.

Infini Capital Management Ltd. is gauging investor interest for full loss insurance on a new class of shares in a fund it launched last year. In exchange, the firm would charge a performance fee as high as 50%, more than double the industry standard.

Although Infini says the offer isn’t linked to growing tension in Hong Kong sparked by China’s new security law, it shows the extent to which hedge funds are willing to boost enticements to attract fresh money.

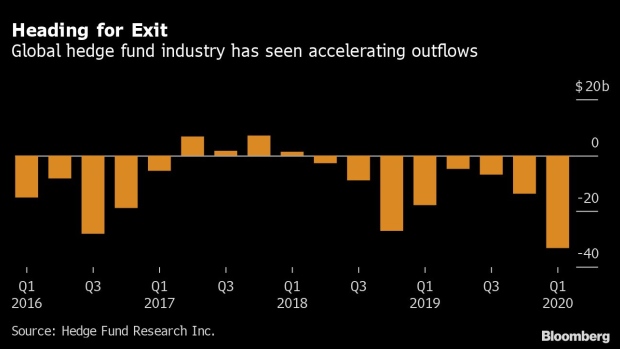

Investors yanked $31 billion in the first four months from the global hedge fund industry as the spread of the Covid-19 virus triggered market selloffs in March and led to the worst monthly performance since the 2008 global financial crisis, according to eVestment. Capital raising has been especially challenging for younger funds.

“This offering is to hopefully get some investors over the edge who might still have some concerns about being an early investor in Infini,” Chief Operating Officer Michael Friedlander said in an interview.

Terms for the proposed new share class have yet to be finalized. Chief Executive Officer Tony Chin has offered to use his investment in the founder share class of the fund to offset any losses for investors in the new share class when they redeem, said Friedlander. Chin has so far invested $70 million of his personal fortune in the one-year-old fund.

The challenging capital raising environment has prompted funds to tweak fee structures to entice investors. London-based Selwood Asset Management is luring some clients with a promise not to charge a performance fee until its flagship fund’s net asset value has hit its previous peak. That kind of discount is rare even for existing clients in an industry where a 2% cut of assets and 20% of returns used to be the standard.

Infini tabled the plan as it hired five new portfolio managers in the past six weeks, expanding its investing teams to nine, said Friedlander. New hires include Lin Yin, formerly of Nine Masts Capital Ltd., and Max Martirani, who had a stint with Symmetry Investments. The firm is in talks to recruit three other teams, seeking to take advantage of talent made available by losses and retrenchment at rival firms, he added.

Infini’s founder share class returned 33% in March and 25% in April. Chin is already offering to compensate investors in an existing “early-bird” share class for the first 10% of their losses when they exit, in exchange for a 30% performance fee.

©2020 Bloomberg L.P.