Fancy Apartment Rentals for Paris Olympics See Poor Demand and Price Cuts

Locals who’d hoped to turn a big profit by renting out their posh apartments are now slashing prices by 30%-60%.

Latest Videos

The information you requested is not available at this time, please check back again soon.

Locals who’d hoped to turn a big profit by renting out their posh apartments are now slashing prices by 30%-60%.

The kingdom must overcome a conservative image and concern about human rights. Visit the desert oasis town of AlUla to understand the challenge.

Jury selection was completed Friday for Donald Trump’s first criminal trial, setting the stage for opening arguments Monday in a New York case accusing the former president of falsifying business records to conceal a sex scandal before the 2016 election.

Higher-than-expected interest rates amid persistent inflation are perceived as the biggest threat to financial stability among market participants and observers, according to the Federal Reserve.

Fifth Third Bancorp jumped the most in four months, leading bank stocks higher, with Chief Executive Officer Tim Spence predicting that income from lending has bottomed out.

Feb 18, 2020

, Bloomberg News

(Bloomberg) -- Follow Bloomberg on Telegram for all the investment news and analysis you need.

Hong Kong is heading for its first back-to-back annual recessions on record, as the coronavirus shutdown cripples an economy already battered by months of political unrest.

Economists’ forecasts since the start of February point to a contraction of more than 1% this year, following a 1.2% decline in 2019. That would mark a bigger decline and a slower recovery from the virus than from the SARS episode of 2003, when output roared back after the all-clear was signaled.

Weakened by months of anti-China protests that have kept tourists away and slashed retail receipts, Hong Kong cannot rely on trade and arrivals from the mainland to stoke an economic comeback. The world’s second-largest economy is struggling to restart production after shuttering factories and businesses in an effort to stem the spread of the illness.

“The likelihood of a rapid recovery is very slim this time around,” said Dong Chen, senior Asia economist at Pictet Wealth Management. “Neither the global economic environment nor Hong Kong’s domestic political situation supports it.”

This presents a grim outlook for Hong Kong in 2020 as the government prepares its annual budget, due Feb. 26. Chief Executive Carrie Lam must juggle the needs of the services sector, an increasingly stretched health care system with longstanding issues including the chronic lack of housing, all amid a political crisis that will make bold action even less likely than usual.

The median estimate of economists surveyed by Bloomberg since the start of February is for a 1.2% contraction for 2020. The virus has also steepened forecast contractions for the first two quarters of the year, while delaying an anticipated recovery in earnest into the fourth quarter.

“The impact of the virus on the economy would be severe in the first quarter,” said Samuel Tse, economist with DBS Bank Ltd. “Private consumption, which accounts for over 60% of the city’s GDP, will take the hardest hit.”

Hong Kong was able to recover quickly from SARS in large part due to tourism spending from a booming Chinese economy. Yet circumstances in China now are very different from 2003. The increasingly anti-China nature of the unrest in Hong Kong in recent months also makes it unlikely that mainland tourists will flock to the city even after virus fears abate.

That Chinese economic boom heralded a multi-year rise in wealth and spending in the financial hub of Hong Kong, from the proliferation of luxury shopping centers to an almost six-fold increase in property value and an influx of Chinese investment via stock and bond trading links.

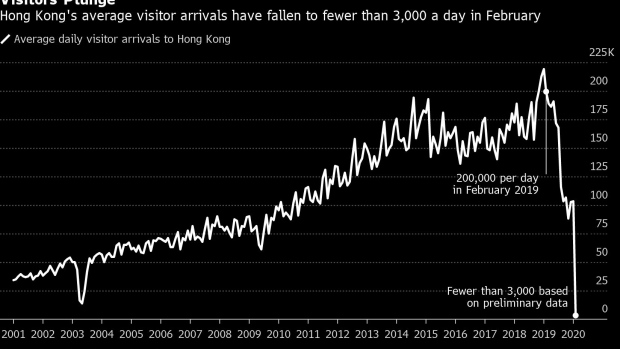

It’s unclear if Hong Kong will ever see visitor levels from the mainland return to the record high of more than five million per month posted before the protests. Mainland visitors typically account for 70% to 80% of total arrivals into the city.

Preliminary visitor arrivals data for February show average daily traffic to the city plummeted to fewer than 3,000 people, according to the Hong Kong Tourism Board. That’s an almost 99% decline from the same period last year, data compiled by Bloomberg show. The jobless rate rose to 3.4% in January for a fourth straight month of increases, according to data released Tuesday.

This makes for a very difficult consumption environment in which to add major government stimulus, said Alicia Garcia Herrero, chief Asia Pacific economist at Natixis SA.

Nevertheless, Lam announced this week that the government will seek approval from the legislature for almost HK$28 billion ($3.6 billion) in fresh funding to reduce the effects of the coronavirus outbreak in the city. The extra spending comes on top of a similar amount rolled out last year to stem the bleeding from months of unrest, as well as another HK$10 billion in livelihood measures announced in January.

Record Deficit

Hong Kong is facing “tsunami-like” shocks and spending pressure from repeated stimulus measures and rising recurring costs may lead to a record budget deficit in the next fiscal year, Financial Secretary Paul Chan said in a blog post Sunday.

Read: Hong Kong’s Finance Chief Cools Talk of Cash Handouts in Budget

Home prices in Hong Kong appear to be holding up for now. Values for used residential units rose 1% between Jan. 19 and Feb. 9, data from Centaline show. Yet transaction volume of the 10 biggest estates in the three weekends after the Lunar New Year dropped 38% from a year earlier, according to Centaline. If prices weaken, that would certainly deal another blow to the city’s economy.

And while the financial system has largely not been hurt through the protests, a longer downturn amid the virus will put lenders at increasing risk, according to Moody’s Investors Service. HSBC Holdings Plc said while reporting fourth quarter results that the coronavirus may lead to further loan losses.

“This situation could well worsen in the days and weeks ahead,” said Steve Vickers, chief executive officer of Steve Vickers & Associates Ltd. and a veteran security analyst in Hong Kong.

--With assistance from Shawna Kwan.

To contact the reporters on this story: Eric Lam in Hong Kong at elam87@bloomberg.net;Cynthia Li in Hong Kong at cli205@bloomberg.net;Enda Curran in hong kong at ecurran8@bloomberg.net

To contact the editors responsible for this story: Jeffrey Black at jblack25@bloomberg.net, Jodi Schneider

©2020 Bloomberg L.P.